Page 19 - Taxforms

P. 19

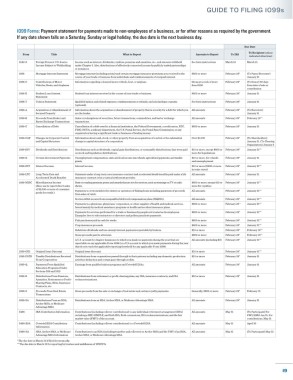

GUIDE TO FILING 1099s

1099 Parts

Required 1099 Forms: Payment statement for payments made to non-employees of a business, or for other reasons as required by the government.

Per State If any date shown falls on a Saturday, Sunday or legal holiday, the due date is the next business day.

State (Parts) Due Date

Alabama (4 or 5) 1099 Ordering Information

Alaska (3) Form Title What to Report Amounts to Report To IRS To Recipient (unless

indicated otherwise)

Arizona (4)

1042-S Foreign Person’s U .S . Source Income such as interest, dividends, royalties, pensions and annuities, etc ., and amounts withheld See form instructions March 15 March 15

Arkansas (4 or 5) Income Subject to Withholding under Chapter 3 . Also, distributions of effectively connected income by publicly traded partnerships

California (3 or 4) >> Sets & Kits or nominees .

Colorado (4 or 5) Order by the number of recipients 1098 Mortgage Interest Statement Mortgage interest (including points) and certain mortgage insurance premiums you received in the $600 or more February 28* (To Payer/Borrower)

course of your trade or business from individuals and reimbursements of overpaid interest .

January 31

Connecticut (4 or 5)

1098-C Contributions of Motor Information regarding a donated motor vehicle, boat, or airplane . Gross proceeds of more February 28* (To Donor) 30 days

Delaware (4 or 5) Vehicles, Boats, and Airplanes than $500 from date of sale or

District of >> Preprinted Forms contribution

Columbia (4) Order by the number of recipients 1098-E Student Loan Interest Student loan interest received in the course of your trade or business . $600 or more February 28* January 31

Statement

Florida (3) Increments of 25 available 1098-T Tuition Statement Qualified tuition and related expenses, reimbursements or refunds, and scholarships or grants See form instructions February 28* January 31

Georgia (3 or 4) Example: 17 employees order 25; (optional) .

Hawaii (5) 1099-A Acquisition or Abandonment of Information about the acquisition or abandonment of property that is security for a debt for which you All amounts February 28* (To Borrower)

Idaho (4 or 5) 67 employees order 75 1099-B Secured Property are the lender . All amounts February 28* January 31

Proceeds From Broker and

February 15**

Sales or redemptions of securities, future transactions, commodities, and barter exchange

Illinois (3 or 4) Barter Exchange Transactions transactions .

Indiana (3 or 4) >> Blank Forms 1099-C Cancellation of Debt Cancellation of a debt owed to a financial institution, the Federal Government, a credit union, RTC, $600 or more February 28* January 31

Iowa (3 or 4) Order by the sheet FDIC, NCUA, a military department, the U .S . Postal Service, the Postal Rate Commission, or any

Kansas (4) Increments of 25 available 1099-CAP Changes in Corporate Control organization having a significant trade or business of lending money . Over $1,000 February 28* (To Shareholders)

Information about cash, stock, or other property from an acquisition of control or the substantial

Kentucky (3 or 4) and Capital Structure change in capital structure of a corporation . January 31 . (To Clearing

Louisiana (3 or 4) Organization) January 5

Maine (4 or 5) 1099-DIV Dividends and Distributions Distributions such as dividends, capital gain distributions, or nontaxable distributions, that were paid $10 or more, except $600 or February 28* January 31**

more for liquidations

on stock and liquidation distributions .

Maryland (3 or 4) 1099-G Certain Government Payments Unemployment compensation, state and local income tax refunds, agricultural payments, and taxable $10 or more, for refunds February 28* January 31

Massachusetts (4 or 5) grants . and unemployment

Michigan (3 or 4) 1099-INT Interest Income Interest income . $10 or more ($600 or more February 28* January 31**

Minnesota (4 or 5) in some cases)

1099-LTC Long-Term Care and Payments under a long-term care insurance contract and accelerated death benefits paid under a life All amounts February 28* January 31

Mississippi (4 or 5) Accelerated Death Benefits insurance contract or by a viatical settlement provider .

Missouri (3 or 4) 1099-MISC Miscellaneous Income Rent or royalty payments; prizes and awards that are not for services, such as winnings on TV or radio $600 or more, except $10 or February 28* January 31**

Montana (4 or 5) (Also, use to report direct sales shows . more for royalties

Nebraska (4 or 5) of $5,000 or more of consumer Payments to crew members by owners or operators of fishing boats including payments of proceeds All amounts February 28* January 31**

goods for resale .)

Nevada (3) Software Compatible with 1099-MISC from sales of catch . All amounts February 28* January 31**

Section 409A income from nonqualified deferred compensation plans (NQDCs) .

New Hampshire (3) Payments to a physician, physicians’ corporation, or other supplier of health and medical services . $600 or more February 28 * January 31**

New Jersey (4) Blank 2up Preprinted 2up Issued mainly by medical assistance programs or health and accident insurance plans .

New Mexico (3 or 4) 1099-ETC (AMS) 1099-ETC (AMS) Payments for services performed for a trade or business by people not treated as its employees . $600 or more February 28* January 31**

New York (3 or 4) Client Accounting Suite ATX W2/1099 Examples: fees to subcontractors or directors and golden parachute payments .

North Carolina (4 or 5) Pensoft Client Accounting Suite Fish purchases paid in cash for resale . $600 or more February 28* January 31**

North Dakota (4 or 5) Yearli Desktop EasyACCT Crop insurance proceeds . $600 or more February 28* January 31**

Ohio (4 or 5) Blank 3up Pensoft Substitute dividends and tax-exempt interest payments reportable by brokers . $10 or more February 28* February 15**

Oklahoma (4 or 5) 1099-ETC (AMS) QuickBooks Basic PR Gross proceeds paid to attorneys . $600 or more February 28* February 15**

January 31**

All amounts (including $0)

February 28*

A U .S . account for chapter 4 purposes to which you made no payments during the year that are

Oregon (3 or 4) EasyACCT QuickBooks Online Edition reportable on any applicable Form 1099 (or a U .S account to which you made payments during the year

Pennsylvania (4 or 5) that do not reach the applicable reporting threshold for any applicable Form 1099)

Rhode Island (4) Pensoft QuickBooks Enhanced PR 1099-OID Original Issue Discount Original issue discount . $10 or more February 28* January 31**

South Carolina (4 or 5) Yearli Desktop QuickBooks Standard PR 1099-PATR Taxable Distributions Received Distributions from cooperatives passed through to their patrons including any domestic production $10 or more February 28* January 31

activities deduction and certain pass-through credits .

From Cooperatives

South Dakota (3) SAGE BusinessWorks 1099-Q Payments From Qualified Earnings from qualified tuition programs and Coverdell ESAs . All amounts February 28* January 31

Tennessee (3) SAGE 50 Payroll Education Programs (Under

Texas (3) TaxWise W2/1099 Sections 529 and 530)

Utah (4 or 5) Yearli Desktop 1099-R Distributions From Pensions, Distributions from retirement or profit-sharing plans, any IRA, insurance contracts, and IRA $10 or more February 28* January 31

recharacterizations .

Annuities, Retirement or Profit-

Vermont (3 or 4) Sharing Plans, IRAs, Insurance

Virginia (4) Contracts, etc .

Washington (3) 1099-S Proceeds From Real Estate Gross proceeds from the sale or exchange of real estate and certain royalty payments . Generally, $600 or more February 28* February 15

Transactions

West Virginia (4) 1099-SA Distributions From an HSA, Distributions from an HSA, Archer MSA, or Medicare Advantage MSA . All amounts February 28* January 31

Wisconsin (4 or 5) Archer MSA, or Medicare

Wyoming (3) Advantage MSA

5498 IRA Contribution Information Contributions (including rollover contributions) to any individual retirement arrangement (IRA) All amounts May 31 (To Participant) For

States noted as 3- or 4-part for including a SEP, SIMPLE, and Roth IRA; Roth conversions; IRA recharacterizations; and the fair FMV/RMD Jan 31; For

1099-MISC filing: If federal market value (FMV) of the account . contributions, May 31

taxes have been withheld on the 5498-ESA Coverdell ESA Contribution Contributions (including rollover contributions) to a Coverdell ESA . All amounts May 31 April 30

1099-MISC, then a 4-part form Information

is required; otherwise, a copy is 5498-SA HSA, Archer MSA, or Medicare Contributions to an HSA (including transfers and rollovers) or Archer MSA and the FMV of an HSA, All amounts May 31 (To Participant) May 31

not required to be filed with the Advantage MSA Information Archer MSA, or Medicare Advantage MSA .

recipient’s personal taxes. *The due date is March 31 if filed electronically .

**The due date is March 15 for reporting by trustees and middlemen of WHFITs .

Some states require a 5-part

form if Box 16 (State tax

withheld) is filled in on the

1099-MISC form.

18 19