Page 4 - Pressure Seal Tax Catalog

P. 4

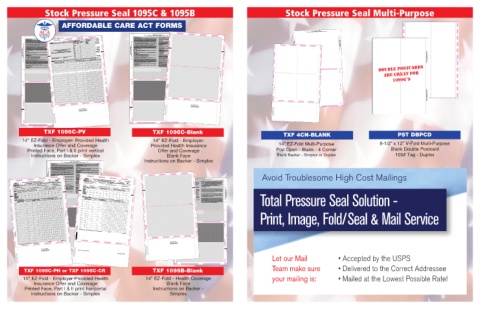

Stock Pressure Seal 1095C & 1095B Stock Pressure Seal Multi-Purpose

AFFORDABLE CARE ACT FORMS

ACA SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN

REMOVE SIDE EDGES FIRST

AFFORDABLE SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN

REMOVE SIDE EDGES FIRST

REMOVE SIDE EDGES FIRST

SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN

CARE ACT

REMOVE SIDE EDGES FIRST

Instructions for Recipient

3

SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN Employer Form 1095-C (2024) 1F. Minimum essential coverage NOT providing minimum value offered to you, or you and your spouse or dependent(s), or Page 2

Employee’s Age 1095–C

you, your spouse, and dependent(s).

You are receiving this Form 1095-C because your employer is an Applicable Large Employer subject to the employer shared

Page 2 responsibility provisions in the Affordable Care Act. This Form 1095-C includes information about the health insurance cover- 1G. You were NOT a full-time employee for any month of the calendar year but were enrolled in self-insured employer-spon-

Form 1095-C (2024) 2 Form Provided age offered to you by your employer. Form 1095-C, Part II, includes information about the coverage, if any, your employer sored coverage for one or more months of the calendar year. This code will be entered in the All 12 Months box or in the

separate monthly boxes for all 12 calendar months on line 14.

Instructions for Recipient 1F. Minimum essential coverage NOT providing minimum value offered to you, or you and your spouse or dependent(s), or OMB No. 1545–2251 offered to you and your spouse and dependent(s). If you purchased health insurance coverage through the Health Insurance

You are receiving this Form 1095-C because your employer is an Applicable Large Employer subject to the employer shared you, your spouse, and dependent(s). CORRECTED 600120 on January 1 Health Marketplace and wish to claim the premium tax credit, this information will assist you in determining whether you are eligible. 1H. No offer of coverage (you were NOT offered any health coverage or you were offered coverage that is NOT minimum

essential coverage).

If you or your family members are eligible for certain types of minimum essential coverage, you may not be eligible for the

1G. You were NOT a full-time employee for any month of the calendar year but were enrolled in self-insured employer-spon-

responsibility provisions in the Affordable Care Act. This Form 1095-C includes information about the health insurance cover- sored coverage for one or more months of the calendar year. This code will be entered in the All 12 Months box or in the Part II Employee Offer 16 Section 17 Zip Code premium tax credit. For more information about the premium tax credit, see Pub. 974, Premium Tax Credit (PTC). 1I. Reserved for future use.

VOID

age offered to you by your employer. Form 1095-C, Part II, includes information about the coverage, if any, your employer of Coverage Insurance You may receive multiple Forms 1095-C if you had multiple employers during the year that were Applicable Large 1J. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to

offered to you and your spouse and dependent(s). If you purchased health insurance coverage through the Health Insurance separate monthly boxes for all 12 calendar months on line 14. 14 Offer of 15 Employee Required 4980H Safe your spouse; and minimum essential coverage NOT offered to your dependent(s).

Marketplace and wish to claim the premium tax credit, this information will assist you in determining whether you are eligible. 1H. No offer of coverage (you were NOT offered any health coverage or you were offered coverage that is NOT minimum Plan Start Coverage Contribution Harbor and Employers (for example, you left employment with one Applicable Large Employer and began a new position of employment

state or province, country, ZIP or foreign postal code, and telephone no.

1J. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to Mo. (Enter

If you or your family members are eligible for certain types of minimum essential coverage, you may not be eligible for the essential coverage). APPLICABLE LARGE EMPLOYER’S name, street address, city or town, (enter (see instructions) Other Relief Offer and with another Applicable Large Employer). In that situation, each Form 1095-C would have information only about the health 1K. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered 41884 PSDBPCD

to your spouse; and minimum essential coverage offered to your dependent(s).

(enter code,

1I. Reserved for future use.

insurance coverage offered to you by the employer identified on the form. If your employer is not an Applicable Large

premium tax credit. For more information about the premium tax credit, see Pub. 974, Premium Tax Credit (PTC). Part I required Employer, it is not required to furnish you a Form 1095-C providing information about the health coverage it offered. In addi- 1L. Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using

You may receive multiple Forms 1095-C if you had multiple employers during the year that were Applicable Large 2-digit no.): code) if applicable) Coverage employee’s primary residence ZIP code. FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST

Employers (for example, you left employment with one Applicable Large Employer and began a new position of employment G your spouse; and minimum essential coverage NOT offered to your dependent(s). tion, if you, or any other individual who is offered health coverage because of their relationship to you (referred to here as 1M. Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined by using employee’s

with another Applicable Large Employer). In that situation, each Form 1095-C would have information only about the health 1K. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered family members), enrolled in your employer’s health plan and that plan is a type of plan referred to as a “self-insured” plan,

insurance coverage offered to you by the employer identified on the form. If your employer is not an Applicable Large to your spouse; and minimum essential coverage offered to your dependent(s). All 12 $ Form 1095-C, Part III, provides information about you and your family members who had certain health coverage (referred to primary residence ZIP code. REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION

1L. Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using

as “minimum essential coverage”) for some or all months during the year.

1N. Individual coverage HRA offered to you, spouse, and dependent(s) with affordability determined by using employee’s pri-

Employer, it is not required to furnish you a Form 1095-C providing information about the health coverage it offered. In addi- Months If your employer provided you or a family member health coverage through an insured health plan or in another manner, mary residence ZIP code.

tion, if you, or any other individual who is offered health coverage because of their relationship to you (referred to here as employee’s primary residence ZIP code. Mar $ $ $ For Privacy you may receive information about the coverage separately on Form 1095-B, Health Coverage. Similarly, if you or a family 1O. Individual coverage HRA offered to you only using the employee’s primary employment site ZIP code affordability safe har-

1M. Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined by using employee’s Jan

family members), enrolled in your employer’s health plan and that plan is a type of plan referred to as a “self-insured” plan,

Form 1095-C, Part III, provides information about you and your family members who had certain health coverage (referred to

primary residence ZIP code.

member obtained minimum essential coverage from another source, such as a government-sponsored program, an individual

bor.

1P. Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee’s primary employment site

as “minimum essential coverage”) for some or all months during the year.

1N. Individual coverage HRA offered to you, spouse, and dependent(s) with affordability determined by using employee’s pri-

market plan, or miscellaneous coverage designated by the Department of Health and Human Services, you may receive

ZIP code affordability safe harbor.

1O. Individual coverage HRA offered to you only using the employee’s primary employment site ZIP code affordability safe har- Feb

information about that coverage on Form 1095-B. If you or a family member enrolled in a qualified health plan through a

mary residence ZIP code.

Act and

Health Insurance Marketplace, the Health Insurance Marketplace will report information about that coverage on Form 1095-A,

1Q. Individual coverage HRA offered to you, spouse, and dependent(s) using the employee’s primary employment site ZIP

If your employer provided you or a family member health coverage through an insured health plan or in another manner,

you may receive information about the coverage separately on Form 1095-B, Health Coverage. Similarly, if you or a family

code affordability safe harbor.

Paperwork

member obtained minimum essential coverage from another source, such as a government-sponsored program, an individual

bor.

REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION Health Insurance Marketplace, the Health Insurance Marketplace will report information about that coverage on Form 1095-A, H ZIP code affordability safe harbor. and the latest information. Apr May June July Aug Sept FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST $ $ $ $ $ $ $ see separate REMOVE THESE EDGES FIRST REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION FOLD, CREASE AND TEAR ALONG PERFORATION Additional information. For additional information about the tax provisions of the Affordable Care Act (ACA), the premium spouse, and dependents. FOLD, CREASE AND TEAR ALONG PERFORATION FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST REMOVE THESE EDGES FIRST

Do not attach to your tax return. Keep for your records.

Health Insurance Marketplace Statement.

1P. Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee’s primary employment site

Reduction

1R. Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee,

market plan, or miscellaneous coverage designated by the Department of Health and Human Services, you may receive

spouse, and dependents. Go to www.irs.gov/Form1095C for instructions

1Q. Individual coverage HRA offered to you, spouse, and dependent(s) using the employee’s primary employment site ZIP

Act Notice,

information about that coverage on Form 1095-B. If you or a family member enrolled in a qualified health plan through a

Employers are required to furnish Form 1095-C only to the employee. As the recipient of this Form 1095-C,

1S. Individual coverage HRA offered to an individual who was not a full-time employee.

1T. Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employ-

you should provide a copy to any family members covered under a self-insured employer-sponsored plan

code affordability safe harbor.

ee’s primary residence ZIP code.

Health Insurance Marketplace Statement.

1R. Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee,

listed in Part III if they request it for their records.

EMPLOYEE’S First name, middle name, last name, street address (including

apartment no.), city or town, state or province, country, ZIP or foreign postal code

1U. Individual coverage HRA offered to employee and spouse (no dependents) using employee’s primary employment site

instructions.

ZIP code affordability safe harbor.

1S. Individual coverage HRA offered to an individual who was not a full-time employee.

Employers are required to furnish Form 1095-C only to the employee. As the recipient of this Form 1095-C,

1V. Reserved for future use.

you should provide a copy to any family members covered under a self-insured employer-sponsored plan

1T. Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employ-

1W. Reserved for future use.

ee’s primary residence ZIP code.

1X. Reserved for future use.

tax credit, and the employer shared responsibility provisions, visit www.irs.gov/ACA or call the IRS Healthcare Hotline for

listed in Part III if they request it for their records.

ACA questions (800-919-0452).

1U. Individual coverage HRA offered to employee and spouse (no dependents) using employee’s primary employment site

ZIP code affordability safe harbor.

Part I. Employee

1Y. Reserved for future use.

1Z. Reserved for future use.

1V. Reserved for future use.

Lines 1–6. Part I, lines 1 through 6, reports information about you, the employee.

Additional information. For additional information about the tax provisions of the Affordable Care Act (ACA), the premium

Line 15. This line reports the employee required contribution, which is the monthly cost to you for the lowest cost self-only

tax credit, and the employer shared responsibility provisions, visit www.irs.gov/ACA or call the IRS Healthcare Hotline for

1W. Reserved for future use.

Department of the

Line 2. This is your social security number (SSN). For your protection, this form may show only the last four digits of your

minimum essential coverage providing minimum value that your employer offered you. For an individual coverage HRA, the

1X. Reserved for future use.

ACA questions (800-919-0452).

SSN. However, the employer is required to report your complete SSN to the IRS.

employee required contribution is the excess of the monthly premium based on the employee’s applicable age for the appli-

1Y. Reserved for future use.

Part I. Applicable Large Employer Member (Employer)

Part I. Employee

Lines 1–6. Part I, lines 1 through 6, reports information about you, the employee.

HRA amount divided by 12). See the Instructions for Forms 1094-C and 1095-C for more details. The amount reported on

Line 15. This line reports the employee required contribution, which is the monthly cost to you for the lowest cost self-only

Line 2. This is your social security number (SSN). For your protection, this form may show only the last four digits of your

Line 10. This line includes a telephone number for the person whom you may call if you have questions about the informa-

SSN. However, the employer is required to report your complete SSN to the IRS.

tion reported on the form or to report errors in the information on the form and ask that they be corrected.

line 15 may not be the amount you paid for coverage if, for example, you chose to enroll in more expensive coverage such

APPLICABLE LARGE EMPLOYER’S

number (SSN)

minimum essential coverage providing minimum value that your employer offered you. For an individual coverage HRA, the

as family coverage. Line 15 will show an amount only if code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, or 1U is

employee required contribution is the excess of the monthly premium based on the employee’s applicable age for the appli-

If Employer provided self-insured coverage, check the box and enter the information for each individual enrolled in coverage, including the employee.

Part II. Employer Offer of Coverage, Lines 14–17

cable lowest cost silver plan over the monthly individual coverage HRA amount (generally, the annual individual coverage

identification number (EIN)

Part I. Applicable Large Employer Member (Employer)

entered on line 14. If you were offered coverage but there is no cost to you for the coverage, this line will report “0.00” for the

Lines 7–13. Part I, lines 7 through 13, reports information about your employer.

Line 14. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and

amount. For more information, including on how your eligibility for other healthcare arrangements might affect the amount

HRA amount divided by 12). See the Instructions for Forms 1094-C and 1095-C for more details. The amount reported on

dependent(s), if any. (If you received an offer of coverage through a multiemployer plan due to your membership in a union,

Line 10. This line includes a telephone number for the person whom you may call if you have questions about the informa- 1Z. Reserved for future use. EMPLOYEE’S social security Oct Nov Dec $ $ (e) Months of coverage Treasury -- IRS Lines 7–13. Part I, lines 7 through 13, reports information about your employer. cable lowest cost silver plan over the monthly individual coverage HRA amount (generally, the annual individual coverage TEAR AT THIS PERFORATION TO OPEN, FOLD, AND

reported on line 15, visit IRS.gov.

that offer may not be shown on line 14.) The information on line 14 relates to eligibility for coverage subsidized by the premi-

line 15 may not be the amount you paid for coverage if, for example, you chose to enroll in more expensive coverage such

tion reported on the form or to report errors in the information on the form and ask that they be corrected. as family coverage. Line 15 will show an amount only if code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, or 1U is (d) Line 16. This code provides the IRS information to administer the employer shared responsibility provisions. Other than a

Part II. Employer Offer of Coverage, Lines 14–17 entered on line 14. If you were offered coverage but there is no cost to you for the coverage, this line will report “0.00” for the all 12 mos. Jan Feb Mar AprMay June July Aug SeptOct Nov Dec um tax credit for you, your spouse, and dependent(s). For more information about the premium tax credit, see Pub. 974. code 2C, which reflects your enrollment in your employer’s coverage, none of this information affects your eligibility for the

Line 14. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and 55447 amount. For more information, including on how your eligibility for other healthcare arrangements might affect the amount (c) DOB (If SSN or other Covered 1A. Minimum essential coverage providing minimum value offered to you with an employee required contribution for self-only premium tax credit. 8402635

coverage equal to or less than 9.5% (as adjusted) of the 48 contiguous states single federal poverty line and minimum essen-

Part III

dependent(s), if any. (If you received an offer of coverage through a multiemployer plan due to your membership in a union, reported on line 15, visit IRS.gov. Covered Individuals TIN is not available) tial coverage offered to your spouse and dependent(s) (referred to here as a Qualifying Offer). This code may be used to Line 17. This line reports the applicable ZIP code your employer used for determining affordability if you were offered an indi-

(b) SSN or other TIN

that offer may not be shown on line 14.) The information on line 14 relates to eligibility for coverage subsidized by the premi- Line 16. This code provides the IRS information to administer the employer shared responsibility provisions. Other than a report for specific months for which a Qualifying Offer was made, even if you did not receive a Qualifying Offer for all 12 vidual coverage HRA. If code 1L, 1M, 1N, or 1T was used on line 14, this will be your primary residence location. If code 1O,

(a) Name of covered individual(s)

um tax credit for you, your spouse, and dependent(s). For more information about the premium tax credit, see Pub. 974. 1P, 1Q, or 1U was used on line 14, this will be your primary employment site. For more information about individual coverage

1A. Minimum essential coverage providing minimum value offered to you with an employee required contribution for self-only code 2C, which reflects your enrollment in your employer’s coverage, none of this information affects your eligibility for the months of the calendar year. For information on the adjustment of the 9.5%, visit IRS.gov.

coverage equal to or less than 9.5% (as adjusted) of the 48 contiguous states single federal poverty line and minimum essen- premium tax credit. First name, middle initial, last name 1B. Minimum essential coverage providing minimum value offered to you and minimum essential coverage NOT offered to HRAs, visit IRS.gov.

your spouse or dependent(s).

Part III. Covered Individuals, Lines 18–35

Line 17. This line reports the applicable ZIP code your employer used for determining affordability if you were offered an indi-

tial coverage offered to your spouse and dependent(s) (referred to here as a Qualifying Offer). This code may be used to vidual coverage HRA. If code 1L, 1M, 1N, or 1T was used on line 14, this will be your primary residence location. If code 1O, 1C. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your Part III reports the name, SSN (or TIN for covered individuals other than the employee listed in Part I), and coverage informa-

report for specific months for which a Qualifying Offer was made, even if you did not receive a Qualifying Offer for all 12 tion about each individual (including any full-time employee and non-full-time employee, and any employee’s family members)

months of the calendar year. For information on the adjustment of the 9.5%, visit IRS.gov. 1P, 1Q, or 1U was used on line 14, this will be your primary employment site. For more information about individual coverage dependent(s) but NOT your spouse.

1B. Minimum essential coverage providing minimum value offered to you and minimum essential coverage NOT offered to HRAs, visit IRS.gov. 1D. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your covered under the employer’s health plan, if the plan is “self-insured.” A date of birth will be entered in column (c) only if an

your spouse or dependent(s). Part III. Covered Individuals, Lines 18–35 spouse but NOT your dependent(s). SSN (or TIN for covered individuals other than the employee listed in Part I) is not entered in column (b). Column (d) will be

18

checked if the individual was covered for at least one day in every month of the year. For individuals who were covered for

1E. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your

1C. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your Part III reports the name, SSN (or TIN for covered individuals other than the employee listed in Part I), and coverage informa- dependent(s) and spouse. some but not all months, information will be entered in column (e) indicating the months for which these individuals were cov-

dependent(s) but NOT your spouse. tion about each individual (including any full-time employee and non-full-time employee, and any employee’s family members) ered. If there are more than 18 covered individuals, additional copies of page 3 may be used.

8402798

1D. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your covered under the employer’s health plan, if the plan is “self-insured.” A date of birth will be entered in column (c) only if an

spouse but NOT your dependent(s). SSN (or TIN for covered individuals other than the employee listed in Part I) is not entered in column (b). Column (d) will be

1E. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your checked if the individual was covered for at least one day in every month of the year. For individuals who were covered for DOUBLE POSTCARDS

19

dependent(s) and spouse. some but not all months, information will be entered in column (e) indicating the months for which these individuals were cov-

ered. If there are more than 18 covered individuals, additional copies of page 3 may be used.

20

ARE GREAT FOR

21

1099G’S

22

Patent Number US 7,975,904 B2

23

24

25

TXF 1095C-B

26

27 59416

28 5

TXF 1095C-PV 29 30 TO OPEN, FOLD, AND

31

D TEAR AT THIS PERFORATION

32 PSF4CN-BLANK

E

33 Form 1095-C

PSFEZ-BLANK-POP 34 35 (202 ) First-Class Mail

Document Enclosed

First-Class Mail SEE REVERSE SIDE FOR Important Tax Return

Important Tax Return OPENING INSTRUCTIONS

Document Enclosed SEE REVERSE SIDE FOR OPENING INSTRUCTIONS

SEE REVERSE SIDE FOR OPENING INSTRUCTIONS

TXF 1095C-PV TXF 1095C-Blank

TXF 4CN-BLANK PST DBPCD

14” EZ-Fold - Employer- Provided Health 14” EZ-Fold - Employer-

Insurance Offer and Coverage Provided Health Insurance 14” EZ-Fold Multi-Purpose 8-1/2” x 12” V-Fold Multi-Purpose

Printed Face, Part I & II print vertical Offer and Coverage Pop Open - Blank - 4 Corner Blank Double Postcard

Instructions on Backer - Simplex Blank Face Blank Backer - Simplex or Duplex 100# Tag - Duplex

Instructions on Backer - Simplex

REMOVE SIDE EDGES FIRST

REMOVE SIDE EDGES FIRST

SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN

SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN

Form 1095-C (2024) Page 2

Instructions for Recipient 1F. Minimum essential coverage NOT providing minimum value offered to you, or you and your spouse or dependent(s), or

You are receiving this Form 1095-C because your employer is an Applicable Large Employer subject to the employer shared you, your spouse, and dependent(s).

responsibility provisions in the Affordable Care Act. This Form 1095-C includes information about the health insurance cover- 1G. You were NOT a full-time employee for any month of the calendar year but were enrolled in self-insured employer-spon-

age offered to you by your employer. Form 1095-C, Part II, includes information about the coverage, if any, your employer sored coverage for one or more months of the calendar year. This code will be entered in the All 12 Months box or in the

separate monthly boxes for all 12 calendar months on line 14.

offered to you and your spouse and dependent(s). If you purchased health insurance coverage through the Health Insurance 1H. No offer of coverage (you were NOT offered any health coverage or you were offered coverage that is NOT minimum

Marketplace and wish to claim the premium tax credit, this information will assist you in determining whether you are eligible.

If you or your family members are eligible for certain types of minimum essential coverage, you may not be eligible for the essential coverage).

premium tax credit. For more information about the premium tax credit, see Pub. 974, Premium Tax Credit (PTC). 1I. Reserved for future use.

You may receive multiple Forms 1095-C if you had multiple employers during the year that were Applicable Large 1J. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to

Employers (for example, you left employment with one Applicable Large Employer and began a new position of employment your spouse; and minimum essential coverage NOT offered to your dependent(s).

with another Applicable Large Employer). In that situation, each Form 1095-C would have information only about the health 1K. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered

insurance coverage offered to you by the employer identified on the form. If your employer is not an Applicable Large to your spouse; and minimum essential coverage offered to your dependent(s).

Employer, it is not required to furnish you a Form 1095-C providing information about the health coverage it offered. In addi- 1L. Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using

employee’s primary residence ZIP code.

tion, if you, or any other individual who is offered health coverage because of their relationship to you (referred to here as

1M. Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined by using employee’s

family members), enrolled in your employer’s health plan and that plan is a type of plan referred to as a “self-insured” plan,

primary residence ZIP code.

Form 1095-C, Part III, provides information about you and your family members who had certain health coverage (referred to

1N. Individual coverage HRA offered to you, spouse, and dependent(s) with affordability determined by using employee’s pri-

as “minimum essential coverage”) for some or all months during the year.

If your employer provided you or a family member health coverage through an insured health plan or in another manner,

mary residence ZIP code.

you may receive information about the coverage separately on Form 1095-B, Health Coverage. Similarly, if you or a family

1O. Individual coverage HRA offered to you only using the employee’s primary employment site ZIP code affordability safe har-

bor.

member obtained minimum essential coverage from another source, such as a government-sponsored program, an individual

REMOVE THESE EDGES FIRST REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION FOLD, CREASE AND TEAR ALONG PERFORATION market plan, or miscellaneous coverage designated by the Department of Health and Human Services, you may receive 1P. Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee’s primary employment site FOLD, CREASE AND TEAR ALONG PERFORATION FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST REMOVE THESE EDGES FIRST SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN Avoid Troublesome High Cost Mailings

ZIP code affordability safe harbor.

information about that coverage on Form 1095-B. If you or a family member enrolled in a qualified health plan through a

Health Insurance Marketplace, the Health Insurance Marketplace will report information about that coverage on Form 1095-A,

1Q. Individual coverage HRA offered to you, spouse, and dependent(s) using the employee’s primary employment site ZIP

code affordability safe harbor.

Health Insurance Marketplace Statement.

1R. Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee,

spouse, and dependents.

Employers are required to furnish Form 1095-C only to the employee. As the recipient of this Form 1095-C,

1S. Individual coverage HRA offered to an individual who was not a full-time employee.

1T. Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employ-

you should provide a copy to any family members covered under a self-insured employer-sponsored plan

ee’s primary residence ZIP code.

listed in Part III if they request it for their records.

1U. Individual coverage HRA offered to employee and spouse (no dependents) using employee’s primary employment site

Form 1095-C

REMOVE SIDE EDGES FIRST

600120

1V. Reserved for future use.G

ZIP code affordability safe harbor.

Additional information. For additional information about the tax provisions of the Affordable Care Act (ACA), the premium

tax credit, and the employer shared responsibility provisions, visit www.irs.gov/ACA or call the IRS Healthcare Hotline for

1W. Reserved for future use.

Part I. Employee 202

Internal Revenue Service

ACA questions (800-919-0452).

1Y. Reserved for future use.

Part I

Employer-Provided Health Insurance Offer and Coverage VOID CORRECTED OMB No. 1545-2251 1X. Reserved for future use. Department of the Treasury Employer-Provided Health Insurance Offer and Coverage VOID OMB No. 1545-2251 600120 Instructions for Recipient If you or another family member received health insurance coverage Page 2

Form 1095-B (2024)

1Z. Reserved for future use.

Employee

Lines 1–6. Part I, lines 1 through 6, reports information about you, the employee.

Line 15. This line reports the employee required contribution, which is the monthly cost to you for the lowest cost self-only

Line 2. This is your social security number (SSN). For your protection, this form may show only the last four digits of your

▶ Do not attach to your tax return. Keep for your records.

▼ Do not attach to your tax return. Keep for your records.

minimum essential coverage providing minimum value that your employer offered you. For an individual coverage HRA, the

Applicable Large Employer Member (Employer)

through a Health Insurance Marketplace (also known as an Exchange),

▶ Go to www.irs.gov/Form1095C for instructions and the latest information.

SSN. However, the employer is required to report your complete SSN to the IRS.

8 Employer identification number (EIN)

Form 1095-C ▼ Go to www.irs.gov/Form1095C for instructions and the latest information. Part I. Applicable Large Employer Member (Employer) cable lowest cost silver plan over the monthly individual coverage HRA amount (generally, the annual individual coverage 7 Name of employer CORRECTED 2 20 02 This Form 1095-B provides information about the individuals in your tax family (your- that coverage will generally be reported on a Form 1095-A rather than a

1 Name of employee (first name, middle initial, last name)

employee required contribution is the excess of the monthly premium based on the employee’s applicable age for the appli- 2 Social security number (SSN)

HRA amount divided by 12). See the Instructions for Forms 1094-C and 1095-C for more details. The amount reported on

Lines 7–13. Part I, lines 7 through 13, reports information about your employer.

self, spouse, and dependents) who had certain health coverage (referred to as “mini-

mum essential coverage”) for some or all months during the year. Minimum essential

Form 1095-B. If you or another family member received employer-

Line 10. This line includes a telephone number for the person whom you may call if you have questions about the informa-

3 Street address (including apartment no.)

line 15 may not be the amount you paid for coverage if, for example, you chose to enroll in more expensive coverage such

10 Contact telephone number

Department of the Treasury 2 Social security number (SSN) 7 Name of employer tion reported on the form or to report errors in the information on the form and ask that they be corrected. as family coverage. Line 15 will show an amount only if code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, or 1U is 8 coverage includes government-sponsored programs, eligible employer-sponsored (Part III) rather than a Form 1095-B. For more information, see

Applicable Large Employer Member (Employer)

sponsored coverage, that coverage may be reported on a Form 1095-C

Part II. Employer Offer of Coverage, Lines 14–17

Internal Revenue Service

entered on line 14. If you were offered coverage but there is no cost to you for the coverage, this line will report “0.00” for the

J

plans, individual market plans, and other coverage the Department of Health and

13 Country and ZIP or foreign postal code

Line 14. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and

Part I

Employee

1 Name of employee (first name, middle initial, last name) 9 Street address (including room or suite no.) dependent(s), if any. (If you received an offer of coverage through a multiemployer plan due to your membership in a union, reported on line 15, visit IRS.gov. 4 City or town 5 State or province 9 Street address (including room or suite no.) 10 Contact telephone number 1 Human Services designates as minimum essential coverage. www.irs.gov/Affordable-Care-Act/Questions-and-Answers-About-Health-Care-

amount. For more information, including on how your eligibility for other healthcare arrangements might affect the amount

Information-Forms-for-Individuals.

that offer may not be shown on line 14.) The information on line 14 relates to eligibility for coverage subsidized by the premi-

12 State or province

If individuals in your tax family are eligible for certain types of minimum essential

code 2C, which reflects your enrollment in your employer’s coverage, none of this information affects your eligibility for the

Part II

um tax credit for you, your spouse, and dependent(s). For more information about the premium tax credit, see Pub. 974.

3 Street address (including apartment no.) 6 Country and ZIP or foreign postal code 11 City or town 1A. Minimum essential coverage providing minimum value offered to you with an employee required contribution for self-only premium tax credit. Employee Offer of Coverage coverage, you may not be eligible for the premium tax credit. For more information on Line 9. Reserved.

Line 16. This code provides the IRS information to administer the employer shared responsibility provisions. Other than a 6 Country and ZIP or foreign postal code 11 City or town

coverage equal to or less than 9.5% (as adjusted) of the 48 contiguous states single federal poverty line and minimum essen-

All 12 Months

F 5 State or province Plan Start Month (Enter 2-digit number): Nov Dec vidual coverage HRA. If code 1L, 1M, 1N, or 1T was used on line 14, this will be your primary residence location. If code 1O, Mar 12 State or province Part II. Information About Certain Employer-Sponsored Coverage, lines 10–15. If

tial coverage offered to your spouse and dependent(s) (referred to here as a Qualifying Offer). This code may be used to

the premium tax credit, see Pub. 974, Premium Tax Credit (PTC).

Line 17. This line reports the applicable ZIP code your employer used for determining affordability if you were offered an indi-

Jan

14 Offer of

report for specific months for which a Qualifying Offer was made, even if you did not receive a Qualifying Offer for all 12

Feb

1P, 1Q, or 1U was used on line 14, this will be your primary employment site. For more information about individual coverage

4 City or town Employee’s Age on January 1 June July Aug Sept months of the calendar year. For information on the adjustment of the 9.5%, visit IRS.gov. HRAs, visit IRS.gov. Coverage (enter Employee’s Age on January 1 June July Plan Start Month (enter 2-digit number): Providers of minimum essential coverage are required to furnish only one you had employer-sponsored health coverage, this part may provide information about

Apr

13 Country and ZIP or foreign postal code

Oct

required code)

1B. Minimum essential coverage providing minimum value offered to you and minimum essential coverage NOT offered to

May

your spouse or dependent(s).

the employer sponsoring the coverage. This part may show only the last four digits of

Part III. Covered Individuals, Lines 18–35

Form 1095-B for all individuals whose coverage is reported on that form.

15 Employee

As the recipient of this Form 1095-B, you should provide a copy to other

Aug

Employee Offer of Coverage Mar Apr May dependent(s) but NOT your spouse. tion about each individual (including any full-time employee and non-full-time employee, and any employee’s family members) Sept Oct Nov individuals covered under the policy if they request it for their records. the employer’s EIN. This part may also be left blank, even if you had employer-spon-

Part III reports the name, SSN (or TIN for covered individuals other than the employee listed in Part I), and coverage informa-

1C. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your

Required

Contribution (see

Part II Jan Feb 1D. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your covered under the employer’s health plan, if the plan is “self-insured.” A date of birth will be entered in column (c) only if an Dec sored health coverage. If this part is blank, you do not need to fill in the information or

instructions)

$

$

SSN (or TIN for covered individuals other than the employee listed in Part I) is not entered in column (b). Column (d) will be

All 12 Months 1E. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your checked if the individual was covered for at least one day in every month of the year. For individuals who were covered for Additional information. For additional information about the tax provisions of the

$

spouse but NOT your dependent(s).

return it to your employer or other coverage provider.

$

$

$

$

16 Section 4980H

14 Offer of $ $ $ dependent(s) and spouse. some but not all months, information will be entered in column (e) indicating the months for which these individuals were cov- $ $ $ Affordable Care Act (ACA) and the premium tax credit, see www.irs.gov/ACA or call Part III. Issuer or Other Coverage Provider, lines 16–22. This part reports informa- FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST

Safe Harbor and

ered. If there are more than 18 covered individuals, additional copies of page 3 may be used.

Coverage (enter $ $ code, if applicable) $ $ $ REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION the IRS Healthcare Hotline for ACA questions (800-919-0452). tion about the coverage provider (insurance company, employer providing self-insured

Other Relief (enter

required code)

15 Employee $ $ $ $ 55447 $ $ $ Part I. Responsible Individual, lines 1–9. Part I reports information about you and coverage, government agency sponsoring coverage under a government program

the coverage.

Required

Contribution (see

such as Medicaid or Medicare, or other coverage sponsor). Line 18 reports a tele-

instructions) $ 17 ZIP Code Lines 2 and 3. Line 2 reports your social security number (SSN) or other taxpayer phone number for the coverage provider that you can call if you have questions

16 Section 4980H Covered Individuals the last four digits. However, the coverage provider is required to report your complete

Part III

about the information reported on the form.

identification number (TIN), if applicable. For your protection, this form may show only

Safe Harbor and

Other Relief (enter

code, if applicable) Nov Dec SSN or other TIN, if applicable, to the IRS. Your date of birth will be entered on line 3 Part IV. Covered Individuals, lines 23–40. This part reports the name, SSN or other

(e) Months of Coverage

only if line 2 is blank.

TIN, and coverage information for each covered individual. A date of birth will be

17 ZIP Code If Employer provided self-insured coverage, check the box and enter the information for each individual enrolled in coverage, including the employee. Oct First name, middle initial, last name (b) SSN or other TIN 8402420 Line 8. This is the code for the type of coverage in which you or other covered individ- entered in column (c) only if the SSN or other TIN is not entered in column (b). Column

Sept

(a) Name of covered individual(s)

Aug

June

July

Apr

(d) Covered

(d) will be checked if the individual was covered for at least 1 day in every month of

May

Part III Covered Individuals (b) SSN or other TIN (c) DOB (If SSN all 12 months Jan Feb Mar (c) DOB (if SSN or other (d) Covered uals were enrolled. Only one letter will be entered on this line. the year. For individuals who were covered for some but not all months, information Total Pressure Seal Solution -

or other TIN is

TIN is not available)

A. Small Business Health Options Program (SHOP)

If Employer provided self-insured coverage, check the box and enter the information for each individual enrolled in coverage, including the employee.

all 12 months

(a) Name of covered individual(s) 18 Jan Feb Mar Apr May (e) Months of coverage B. Employer-sponsored coverage will be entered in column (e) indicating the months for which these individuals were

not available)

First name, middle initial, last name

covered. If there are more than eighteen covered individuals, see Part IV, Continuation

July

8402871 Aug Sept Oct Nov Dec C. Government-sponsored program Sheet(s), for information about the additional covered individuals.

June

D. Individual market insurance

18 19 E. Multiemployer plan

F. Other designated minimum essential coverage

G. Individual coverage health reimbursement arrangement (HRA)

20

19

8402719 20 21

22

21

23

22

24

23

25

24 Print, Image, Fold/Seal & Mail Service

Patent Number US 7,975,904 B2

26

25

27

26

D

28

27

TXF 1095C-CR 30

28 29 TXF 1095B-B

29

30 RAA #1607 For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. 41-0852411

TXF 1095C-PH 31 32 Form 1095-C (202 )

33 PSFEZ-BLANK-POP

34 Form 1095-C (202 )

Cat. No. 60705M FROM: First-Class Mail

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Important Tax Return

35

Document Enclosed

A

First-Class Mail

Important Tax Return SEE REVERSE SIDE FOR OPENING INSTRUCTIONS

Document Enclosed SEE REVERSE SIDE FOR OPENING INSTRUCTIONS Important Tax Document Enclosed First-Class Mail

SEE REVERSE SIDE FOR OPENING INSTRUCTIONS Let our Mail • Accepted by the USPS

TXF 1095C-PH or TXF 1095C-CR TXF 1095B-Blank Team make sure • Delivered to the Correct Addressee

14” EZ-Fold - Employer-Provided Health 14” EZ-Fold - Health Coverage your mailing is: • Mailed at the Lowest Possible Rate!

Insurance Offer and Coverage Blank Face

Printed Face, Part I & II print horizontal Instructions on Backer -

Instructions on Backer - Simplex Simplex