Page 5 - Pressure Seal Tax Catalog

P. 5

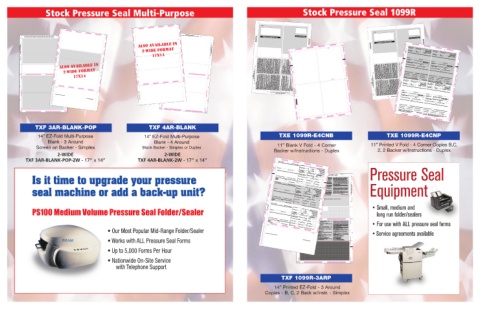

Stock Pressure Seal 1099R

Stock Pressure Seal Multi-Purpose

FROM

FROM

SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN

REMOVE SIDE EDGES FIRST

2. WITH THIS SIDE UP, SLIDE FINGER BETWEEN FRONT AND MIDDLE PANEL, SLIDE FINGER UP TO OPEN First-Class Mail

3. BEFORE DETACHING SLIDE FINGER UP BETWEEN MIDDLE PANEL AND ADDRESS PANEL TO REMOVE IMPORTANT TAX DOCUMENT ENCLOSED

SEE OTHER SIDE FOR OPENING INSTRUCTIONS OPENING INSTRUCTIONS SEE OTHER SIDE FOR IMPORTANT TAX DOCUMENT ENCLOSED First-Class Mail OPENING INSTRUCTIONS SEE OTHER SIDE FOR

FOLD, CREASE AND TEAR ALONG PERFORATION

REMOVE THESE EDGES FIRST

FIRST: REMOVE THESE EDGES FOLD, CREASE AND TEAR ALONG PERFORATION 62519 FOLD, CREASE AND TEAR ALONG PERFORATION FIRST: REMOVE THESE EDGES ALSO AVAILABLE IN FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST SEE OTHER SIDE FOR OPENING INSTRUCTIONS C 8753442 $ 2b Taxable amount CORRECTED (if checked) 12 OMB No. 1545-0119 Date of payment 25 $ Form 1099-R CORRECTED (if checked) OMB No. 1545-0119

2-WIDE FORMAT

Form 1099-R

1 Gross distribution

2a Taxable amount

$

not determined

Distributions From Pensions,

Total

Annuities, Retirement or

distribution

1 Gross distribution

Profit-Sharing Plans, IRAs,

Insurance Contracts, etc.

2a Taxable amount

FATCA filing 13

requirement

$

2b Taxable amount

Total

Annuities, Retirement or

Profit-Sharing Plans, IRAs,

PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no.

Insurance Contracts, etc.

FATCA filing 13

Date of payment

PAYER’S TIN

17X14 A $ 3 Capital gain (included 4 Federal income tax withheld 5 Employee contributions PAYER’S TIN not determined distribution 12 requirement Distributions From Pensions, 25

PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no.

RECIPIENT’S TIN

in box 2a)

distributed to you is also shown. You’ll need this information if you use the 10-year tax option

ALSO AVAILABLE IN 62144 code C is shown in box 7, the amount shown in box 1 is a receipt of reportable death Box 2a. This part of the distribution is generally taxable. If there is no entry in this box, the payer may not have all the facts needed to figure the taxable amount. In that case, the first box in box 2b should be checked. You may want to get one of the free publications from the IRS to help you figure the taxable amount. See Additional information on the back of Copy 2. For an IRA distribution, see Traditional IRAs or Traditional SIMPLE IRAs and Roth IRAs or Roth SIMPLE IRAs, earlier. For a direct rollover, other than from a qualified plan, section 403(b) plan, or governmental section 457(b) plan to a designated Roth account in the same plan or to a Roth IRA, zero should be shown and you must enter zero (-0-) on the “Taxable amount” line of your

When you receive periodic payments from the annuity contract, they’re taxable at that time.

Box 8. If you received an annuity contract as part of a distribution, the value of the contract 6 Net unrealized appreciation

(Form 4972). If you previously received an annuity contract as part of a distribution (or the

If the distribution is made to more than one person, the percentage of the annuity contract

is shown. It isn’t taxable when you receive it and shouldn’t be included in boxes 1 and 2a. in employer’s securities

contract was purchased through a direct rollover from a plan account) and periodic

Y— Qualified charitable distribution (QCD) claimed by taxpayer under section 408(d)(8).

If the IRA/SEP/SIMPLE box is checked, you’ve received a traditional IRA, SEP, or

/Designated Roth contributions

3 Capital gain (included

in box 2a)

4 Federal income tax withheld

/Designated Roth contributions

in employer’s securities

9b Total employee contributions

or insurance premiums

% $

IRA/

2-WIDE FORMAT benefits that is taxable in part. shown in this box plus the amount in box 6, if any. your tax return for more information. distribution was a total distribution that closed out your account. payer Form W-4P or Form W-4R, as applicable. Q— Qualified distribution from a Roth IRA or Roth SIMPLE IRA. recharacterized in 2025. (under age 59½). T— Roth IRA or Roth SIMPLE IRA distribution, exception applies. U— Dividend distribution from ESOP under section 404(k). Note: This distribution isn’t eligible for rollover. combined arrangements. SIMPLE distribution. contract was purchased through a direct rollover from a plan account) and periodic It is used to compute the taxable part of the distribution. See Pub. 575. Box 10. If an amount is reported in this box, see the Instructions for Form 5329 this form is shown in this box. requi

SEP/

SIMPLE

9a Your percentage of total distribution

$

RECIPIENT’S name, street address (including apt. no.), city or town, state or province, country, and ZIP or foreign postal code

% $

9b Total employee contributions

this form is shown in this box.

combined arrangements.

17X14 REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION reported here. received is shown. and Pub. 575. and Pub. 969. FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST benefits that is taxable in part. shown in this box plus the amount in box 6, if any. your tax return for more information. distribution was a total distribution that closed out your account. payer Form W-4P or Form W-4R, as applicable. recharacterized in 2025. (under age 59½). $ Copy 2 $ 17 Local tax withheld 18 Name of locality 11 1st year of desig. Roth contrib. $ $ $ 16 State distribution FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST $ 14 State tax withheld 15 State/Payer’s state no. $ 10 Amount allocable to IRR within 5 years

received is shown.

14 State tax withheld

SIMPLE distribution.

and Pub. 969.

and Pub. 575.

15

10 Amount allocable to IRR within 5 years

reported here. State/Payer’s state no.

Account number (see instructions)

11 1st year of desig. Roth contrib.

19 Local distribution

Note: If code B is in box 7 and an amount is reported in box 10, see the Instructions

these distributions, see the instructions for your tax return. Also, certain distributions may be

8— Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in 2025. www.irs.gov/Form1099R

account in the same plan or to a Roth IRA or Roth SIMPLE IRA, the NUA is included in box

N— Recharacterized IRA contribution made for 2025 and recharacterized in 2025.

choose to include it in your gross income this year. See Pub. 575 and Form 4972. If you roll

2a. If you didn’t receive a lump-sum distribution, the amount shown is the NUA attributable

Box 7. The following codes identify the distribution you received. For more information on

of the employer’s company, the net unrealized appreciation (NUA) (any increase in value of

File this copy with your state, city, or

J— Early distribution from a Roth IRA or Roth SIMPLE IRA, no known exception

D— Annuity payments from nonqualified annuities that may be subject to tax under

E— Distributions under Employee Plans Compliance Resolution System (EPCRS).

6— Section 1035 exchange (a tax-free exchange of life insurance, annuity, qualified

$

17 Local tax withheld

over the distribution to a designated Roth account in the same plan or to a Roth IRA or

G— Direct rollover of a distribution to a qualified plan, a section 403(b) plan, a

H— Direct rollover of a designated Roth account distribution to a Roth IRA or

K— Distribution of traditional IRA assets not having a readily available FMV.

Copy 2

Roth SIMPLE IRA, see the instructions for box 2a. For a direct rollover to a designated Roth local income tax return, when required.

$

16 State distribution

18 Name of locality

Department of the Treasury

PS3AR-BLANK-POP FROM: PSF4AR-BLANK B Instructions for Recipient Generally, distributions from retirement plans (IRAs, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance contracts, etc., are reported to recipients on Form 1099-R. Qualified plans and section 403(b) plans. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer didn’t show the taxable amount in box 2a. See the instructions for your tax return. Traditional IRAs or traditional SIMPLE IRAs. For distributions from a traditional individual retirement arrangement (IRA) or a traditional SIMPLE IRA, generally the payer isn’t required to compute the taxable amount. See the instructions for your tax return to determine the taxable amount. If you’re at least age 73, you must take minimum distributions from your

such securities while in the trust) is taxed only when you sell the securities unless you Form 1099-R

Internal Revenue Service

1— Early distribution, no known exception (in most cases, under age 59½).

1 Gross distribution

19 Local distribution

to employee contributions, which isn’t taxed until you sell the securities.

CORRECTED (if checked)

$

$

subject to an additional 10% tax. See the Instructions for Form 5329.

www.irs.gov/Form1099R

2a Taxable amount

OMB No. 1545-0119

File this copy with your state, city, or

long-term care insurance, or endowment contracts). $

A— May be eligible for 10-year tax option (see Form 4972).

2— Early distribution, exception applies (under age 59½).

local income tax return, when required.

2b Taxable amount

not determined

C— Reportable death benefits under section 6050Y .

Internal Revenue Service

governmental section 457(b) plan, or an IRA.

Form 1099-R

Distributions From Pensions,

Total

1 Gross distribution

Annuities, Retirement or

Department of the Treasury - Internal Revenue Service

distribution

9— Cost of current life insurance protection.

Profit-Sharing Plans, IRAs,

FATCA filing

B— Designated Roth account distribution.

Insurance Contracts, etc.

12

2a Taxable amount

requirement

(in most cases, under age 59½). 13

$

SEE REVERSE SIDE FOR OPENING INSTRUCTIONS Important Tax Document Enclosed First-Class Mail SEE REVERSE SIDE FOR OPENING INSTRUCTIONS REMOVE SIDE EDGES FIRST 3— Disability. 4— Death. THEN FOLD AND TEAR THIS STUB ALONG PERFORATION 7— Normal distribution. for Form 5329. TXE 1099R-E4CNB section 1411. 2 3 1 or a previous year. B Instructions for Recipient Form 1099-R. taxable amount in box 2a. See the instructions for your tax return. information on IRAs. excess contribution. reported your complete TIN to the IRS. to distinguish your account. self-employed. RECIPIENT’S name, street address (including apt. no.), city or town, state or province, country, and ZIP or foreign postal code L— Loans treated as distributions. Date of payment or a previous year. $ $ 6 Net unrealized appreciation $ 7 Distribution code(s) RECIPIENT’S TIN $ 8 Other 5 Employee contributions Date of payment

25

M— Qualified plan loan offset.

Total

not determined

F— Charitable gift annuity.

Distributions From Pensions,

Annuities, Retirement or

5— Prohibited transaction.

Roth SIMPLE IRA.

7— Normal distribution.

Profit-Sharing Plans, IRAs,

distribution

12

requirement

FATCA filing 13

section 1411.

Insurance Contracts, etc.

PAYER’S TIN

for Form 5329.

3— Disability.

4— Death.

3 Capital gain (included

RECIPIENT’S TIN

PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no.

in box 2a)

$

4 Federal income tax withheld

1

PAYER’S TIN

$

6 Net unrealized appreciation

5 Employee contributions

2

in employer’s securities

$

$

/Designated Roth contributions

or insurance premiums

in box 2a)

3

3 Capital gain (included

7 Distribution code(s)

8 Other

IRA/

THEN FOLD AND TEAR THIS STUB ALONG PERFORATION

SEP/

SIMPLE

REMOVE SIDE EDGES FIRST

4 Federal income tax withheld

%

$

9a Your percentage of total distribution

/Designated Roth contributions

in employer’s securities

9b Total employee contributions

or insurance premiums

% $

IRA/

SEP/

SIMPLE

9a Your percentage of total distribution

$

9b Total employee contributions

% $

Account number (see instructions)

$ 14 State tax withheld 11 1st year of desig. Roth contrib. RECIPIENT’S name, street address (including apt. no.), city or town, state or province, country, and ZIP or foreign postal code %

$ 10 Amount allocable to IRR within 5 years

$ 17 Local tax withheld 15 State/Payer’s state no. Account number (see instructions)

$ 16 State distribution

18 Name of locality

$ 14 State tax withheld 11 1st year of desig. Roth contrib.

19 Local distribution

(keep for your records)

$ 10 Amount allocable to IRR within 5 years

$

Copy C For Recipient’s Records

15 State/Payer’s state no.

www.irs.gov/Form1099R

$ 17 Local tax withheld

This information is being furnished to the IRS.

Department of the Treasury

$ 16 State distribution

Internal Revenue Service

Copy B 18 Name of locality

$ 19 Local distribution

www.irs.gov/Form1099R

Report this income on your federal tax return. If this form shows federal

This information is being furnished to the IRS.

income tax withheld in box 4, attach this copy to your return.

TXF 3AR-BLANK-POP TXF 4AR-BLANK

14” EZ-Fold Multi-Purpose 14” EZ-Fold Multi-Purpose TXE 1099R-E4CNB TXE 1099R-E4CNP

Blank - 3 Around Blank - 4 Around

Screen on Backer - Simplex Blank Backer - Simplex or Duplex 11” Blank V Fold - 4 Corner 11” Printed V Fold - 4 Corner Copies B,C,

Backer w/Instructions - Duplex 2, 2 Backer w/Instructions - Duplex

2-WIDE 2-WIDE

TXF 3AR-BLANK-POP-2W - 17” x 14” TXF 4AR-BLANK-2W - 17” x 14”

E Form 1099-R CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, and ZIP or foreign postal code, and telephone no.

1 Gross distribution

8755578 PAYER’S TIN $ 2a Taxable amount OMB No. 1545-0119 Distributions From

RECIPIENT’S TIN $ 2b Taxable amount 25 Pensions, Annuities,

Retirement or

not determined

Total Form 1099-R Profit-Sharing

3 Capital gain (included

in box 2a) distribution

$ 4 Federal income tax withheld Plans, IRAs, Pressure Seal

Insurance

RECIPIENT’S name, street address (incl. apt. no.), city or town, state or province, country, and ZIP or foreign postal code

2. WITH THIS SIDE UP, SLIDE FINGER BETWEEN FRONT AND MIDDLE PANEL, SLIDE FINGER UP TO OPEN

$

Contracts, etc.

3. BEFORE DETACHING SLIDE FINGER UP BETWEEN MIDDLE PANEL AND ADDRESS PANEL TO REMOVE

6 Net unrealized appreciation

$ 9a Your percentage of total distribution 7 Distribution code(s) SEP/ IRA/ $ 8 Other 5 Employee contributions designated Roth account) from a qualified plan, section 403(b) plan, or

in employer’s securities

Is it time to upgrade your pressure Form 1099-R 13 Date of payment 12 FATCA filing $ 11 1st year of desig. Roth contrib. $ $ 17 $ 14 $ Local tax withheld 18 15 Name of locality % $ 9b Total employee contributions have been a direct rollover, a transfer or conversion to a Roth IRA or governmental section 457(b) plan to a designated Roth account in the

insurance premiums

/Designated Roth contributions or

Account number (see instructions)

Box 1. Shows the total amount distributed this year. The amount may

Instructions for Recipient

Copy B

SIMPLE

Roth SIMPLE IRA, a recharacterized IRA contribution; or you may have

Generally, distributions from retirement plans (IRAs, qualified plans,

Report this income on your

same plan or to a Roth IRA, you must include on the “Taxable

amount” line of your tax return the amount shown in this box plus the

received it as periodic payments, nonperiodic payments, or a total

$

federal tax return. If this

distribution. Report the amount on Form 1040, 1040-SR, or 1040-NR

amount in box 6, if any.

form shows federal income

section 403(b) plans, and governmental section 457(b) plans),

requirement

insurance contracts, etc., are reported to recipients on Form 1099-R.

State tax withheld

tax withheld in box 4, attach

this copy to your return.

If this is a total distribution from a qualified plan and you were born

on the line for “IRA distributions” or "Pensions and annuities” (or the

%

Qualified plans and section 403(b) plans. If your annuity starting

This information is being

furnished to the IRS.

line for “Taxable amount”) and on Form 8606, as applicable. However,

before January 2, 1936 (or you’re the beneficiary of someone born

before January 2, 1936), you may be eligible for the 10-year tax option.

date is after 1997, you must use the simplified method to figure your

if this is a lump-sum distribution, see Form 4972. If you haven’t

taxable amount if your payer didn’t show the taxable amount in box

reached minimum retirement age, report your disability payments on

10 Amount allocable to IRR within 5 years

State/Payer’s state no.

See the Form 4972 instructions for more information.

2a. See the instructions for your tax return.

If you’re an eligible retired public safety officer who elected to

the line for “Wages, salaries, tips, etc.” on your tax return. Also report

16

on that line permissible withdrawals from eligible automatic

exclude from income distributions from your eligible plan used to pay

Traditional IRAs or traditional SIMPLE IRAs. For distributions from a

State distribution

traditional individual retirement arrangement (IRA) or a traditional $

contribution arrangements and corrective distributions of excess

deferrals, excess contributions, or excess aggregate contributions

www.irs.gov/Form1099R

SIMPLE IRA, generally the payer isn’t required to compute the taxable

FOLD, CREASE AND TEAR ALONG PERFORATION

certain insurance premiums, the amount shown in box 2a hasn’t been

$

reduced by the exclusion amount. See the instructions for your tax

amount. See the instructions for your tax return to determine the

after-tax contributions or if you’re self-employed.

Box 2b. If the first box is checked, the payer was unable to determine

If a life insurance, annuity, qualified long-term care, or endowment

taxable amount. If you’re at least age 73, you must take minimum Local distribution

the taxable amount and box 2a should be blank, except for a

IRA). If you don’t, you’re subject to an excise tax on the amount that

traditional IRA or traditional SIMPLE IRA. It’s your responsibility to

FIRST: REMOVE THESE EDGES

CORRECTED (if checked)

should’ve been distributed. See Pub. 590-A and Pub. 590-B for more

contract was transferred tax free to another trustee or contract issuer,

an amount will be shown in this box and code 6 will be shown in box

determine the taxable amount. If the second box is checked, the

information on IRAs.

7. If a charge or payment was made against the cash value of an

distribution was a total distribution that closed out your account.

PAYER’S name, street address, city or town, state or province, country, and ZIP or foreign postal code, and telephone no.

1 Gross distribution

annuity contract or the cash surrender value of a life insurance

Roth IRAs or Roth SIMPLE IRAs. For distributions from a Roth IRA

Box 3. If you received a lump-sum distribution from a qualified plan

or Roth SIMPLE IRA, generally the payer isn’t required to compute the

contract for the purchase of qualified long-term care insurance, an

and were born before January 2, 1936 (or you’re the beneficiary of

$ 2a Taxable amount distributions from your IRA (other than a Roth IRA or Roth SIMPLE $ $ 19 except if the distribution is of designated Roth contributions or your return for more information. FOLD, CREASE AND TEAR ALONG PERFORATION FIRST: REMOVE THESE EDGES

Department of the Treasury - Internal Revenue Service

taxable amount. You must compute any taxable amount on Form

amount will be shown in this box and code W will be shown in box 7.

seal machine or add a back-up unit? RECIPIENT’S name, street address (incl. apt. no.), city or town, state or province, country, and ZIP or foreign postal code $ 3 Capital gain (included plan, section 403(b) plan, or governmental section 457(b) plan, you Distributions From Instructions for Form 8949. Equipment

someone born before January 2, 1936), you may be able to elect to

8606. An amount shown in box 2a may be taxable earnings on an

You need not report these amounts on your tax return. If code C is

shown in box 7, the amount shown in box 1 is a receipt of reportable

treat this amount as a capital gain on Form 4972 (not on Schedule D

excess contribution.

PAYER’S TIN

OMB No. 1545-0119

(Form 1040)). See the Form 4972 instructions. For a charitable gift

annuity, report as a long-term capital gain as explained in the

death benefits that is taxable in part.

Loans treated as distributions. If you borrow money from a qualified

25

Box 2a. This part of the distribution is generally taxable. If there is no

$

may have to treat the loan as a distribution and include all or part of

entry in this box, the payer may not have all the facts needed to figure

Box 4. Shows federal income tax withheld. Include this amount on

Pensions, Annuities,

the taxable amount. In that case, the first box in box 2b should be

your income tax return as tax withheld. Generally, if you receive

2b Taxable amount

RECIPIENT’S TIN

checked. You may want to get one of the free publications from the

the amount borrowed in your income. There are exceptions to this rule. Retirement or

IRS to help you figure the taxable amount. See Additional information

payments that aren’t eligible rollover distributions, you can change

Recipient’s taxpayer identification number (TIN). For your

on the back of Copy 2. For an IRA distribution, see Traditional IRAs or

your withholding or elect not to have income tax withheld by giving

protection, this form may show only the last four digits of your TIN

Form 1099-R

not determined

Total

the payer Form W-4P or Form W-4R, as applicable.

Traditional SIMPLE IRAs and Roth IRAs or Roth SIMPLE IRAs, earlier.

(SSN, ITIN, ATIN, or EIN). However, the payer has reported your

If your loan is taxable, code L will be shown in box 7. See Pub. 575. Profit-Sharing

For a direct rollover, other than from a qualified plan, section 403(b)

complete TIN to the IRS.

in box 2a)

distribution

plan, or governmental section 457(b) plan to a designated Roth

Plans, IRAs,

number the payer assigned to distinguish your account.

account in the same plan or to a Roth IRA, zero should be shown and

Insurance

4 Federal income tax withheld

Account number. May show an account, policy, or other unique Contracts, etc.

return. If you roll over a distribution (other than a distribution from a

$

$

6 Net unrealized appreciation

in employer’s securities

$ 5 Employee contributions you must enter zero (-0-) on the “Taxable amount” line of your tax (Continued on the back of Copy C.)

IRA/

insurance premiums

7 Distribution code(s)

/Designated Roth contributions or

SEP/ 8 Other

Account number (see instructions)

SIMPLE

Copy 2 13

9a Your percentage of total distribution

Remove address panel below to view additional instructions on back of copy C

$

Date of payment

File this copy with

12 14

11 1st year of desig. Roth contrib.

your state, city, or

FATCA filing 9b Total employee contributions

local income tax

return, when requirement $ State tax withheld

required. 10 Amount allocable to IRR within 5 years % $ %

$ 15

$ 17 State/Payer’s state no.

$ Local tax withheld 16

$ State distribution

$ 18

www.irs.gov/Form1099R

Form 1099-R

Name of locality $

19 $ $ Local distribution

TXF 1099R-3ARP $ 1 Gross distribution Department of the Treasury - Internal Revenue Service • Small, medium and

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, and ZIP or foreign postal code, and telephone no.

PS100 Medium Volume Pressure Seal Folder/Sealer RECIPIENT’S name, street address (incl. apt. no.), city or town, state or province, country, and ZIP or foreign postal code $ 3 Capital gain (included Total Form 1099-R Pensions, Annuities, long run folder/sealers

OMB No. 1545-0119

PAYER’S TIN

25

2a Taxable amount

Distributions From

RECIPIENT’S TIN

2b Taxable amount

not determined

Retirement or

Profit-Sharing

in box 2a)

distribution

Plans, IRAs,

$

Insurance

$ 4 Federal income tax withheld Contracts, etc.

6 Net unrealized appreciation

$ in employer’s securities 7 Distribution code(s) 5 Employee contributions

$ insurance premiums

/Designated Roth contributions or

IRA/

SEP/

Account number (see instructions)

8 Other

9a Your percentage of total distribution

Copy C 13 11 1st year of desig. Roth contrib. SIMPLE

$

Date of payment

12 14 Instructions for Recipient (Continued) If the IRA/SEP/SIMPLE box is checked, you’ve received a traditional

Records FATCA filing 9b Total employee contributions A— May be eligible for 10-year tax option (see Form 4972).

For Recipient’s

requirement $ State tax withheld Box 5. Generally, this shows the employee’s investment in the contract % B— Designated Roth account distribution. IRA, SEP, or SIMPLE distribution.

Note: If code B is in box 7 and an amount is reported in box 10,

(after-tax contributions), if any, recovered tax free this year; the portion

%

Box 8. If you received an annuity contract as part of a distribution, the

$

$ 15 that’s your basis in a designated Roth account; the part of premiums value of the contract is shown. It isn’t taxable when you receive it and

furnished to the IRS.

$ see the Instructions for Form 5329. shouldn’t be included in boxes 1 and 2a. When you receive periodic

This information is being

paid on commercial annuities or insurance contracts recovered tax

17 State/Payer’s state no. C— Reportable death benefits under section 6050Y.

10 Amount allocable to IRR within 5 years

in a life insurance contract reportable under section 6050Y. This box

$ Local tax withheld free; the nontaxable part of a charitable gift annuity; or the investment D— Annuity payments from nonqualified annuities that may be subject payments from the annuity contract, they’re taxable at that time. If the

16

distribution is made to more than one person, the percentage of the

doesn’t show any IRA contributions. If the amount shown is your basis

to tax under section 1411.

State distribution

$ (keep for your records) 18 Name of locality $ $ $ $ 19 Local distribution E— Distributions under Employee Plans Compliance Resolution annuity contract distributed to you is also shown. You’ll need this • For use with ALL pressure seal forms

information if you use the 10-year tax option (Form 4972). If you

www.irs.gov/Form1099R

in a designated Roth account, the year you first made contributions to

SEE REVERSE SIDE FOR OPENING INSTRUCTIONS Important Tax Document Enclosed 10% tax. See the Instructions for Form 5329. Q— Qualified distribution from a Roth IRA or Roth SIMPLE IRA. Box 11. The first year you made a contribution to the designated Roth • Service agreements available

previously received an annuity contract as part of a distribution (or the

System (EPCRS).

that account may be entered in box 11.

FROM:

F— Charitable gift annuity.

contract was purchased through a direct rollover from a plan account)

Box 6. If you received a lump-sum distribution from a qualified plan

and periodic payments from that annuity contract are included in box 1,

G— Direct rollover of a distribution to a qualified plan, a section 403(b)

the value of the contract as of the end of the year is shown. This

that includes securities of the employer’s company, the net unrealized

plan, a governmental section 457(b) plan, or an IRA.

appreciation (NUA) (any increase in value of such securities while in

information may be provided to your plan administrator to determine any

the trust) is taxed only when you sell the securities unless you choose

required distribution from that plan. If charges were made for qualified

to include it in your gross income this year. See Pub. 575 and Form

H— Direct rollover of a designated Roth account distribution to a Roth

IRA or Roth SIMPLE IRA.

amount of the reduction in the investment (but not below zero) in the

4972. If you roll over the distribution to a designated Roth account in

• Our Most Popular Mid-Range Folder/Sealer Department of the Treasury - Internal Revenue Service J— Early distribution from a Roth IRA or Roth SIMPLE IRA, no known long-term care insurance contracts under combined arrangements, the F

the same plan or to a Roth IRA or Roth SIMPLE IRA, see the

exception (in most cases, under age 59½).

annuity or life insurance contract is reported here.

instructions for box 2a. For a direct rollover to a designated Roth

Box 9a. If a total distribution was made to more than one person, the

K— Distribution of traditional IRA assets not having a readily available

FMV.

account in the same plan or to a Roth IRA or Roth SIMPLE IRA, the

percentage you received is shown.

Box 9b. For a life annuity from a qualified plan or from a section 403(b)

NUA is included in box 2a. If you didn’t receive a lump-sum

L— Loans treated as distributions.

plan (with after-tax contributions), an amount may be shown for the

distribution, the amount shown is the NUA attributable to employee

M—Qualified plan loan offset.

contributions, which isn’t taxed until you sell the securities.

employee’s total investment in the contract. It is used to compute the

taxable part of the distribution. See Pub. 575.

Box 7. The following codes identify the distribution you received. For

N— Recharacterized IRA contribution made for 2025 and

Box 10. If an amount is reported in this box, see the Instructions for

more information on these distributions, see the instructions for your

recharacterized in 2025.

tax return. Also, certain distributions may be subject to an additional

Form 5329 and Pub. 575.

P— Excess contributions plus earnings/excess deferrals (and/or

earnings) taxable in 2024 or a previous year.

account reported on this form is shown in this box.

1— Early distribution, no known exception (in most cases, under age

Box 12. If checked, the payer is reporting on this Form 1099 to satisfy its

59½).

R— Recharacterized IRA contribution made for 2024 or a previous year

Internal Revenue Code chapter 4 account reporting requirement under

and recharacterized in 2025.

2— Early distribution, exception applies (under age 59½).

3— Disability.

FATCA. You may also have a filing requirement. See the Instructions for

4— Death.

Form 8938.

S— Early distribution from a SIMPLE IRA in first 2 years, no known

exception (under age 59½).

Box 13. Shows the date of payment for reportable death benefits under

section 6050Y.

5— Prohibited transaction.

T— Roth IRA or Roth SIMPLE IRA distribution, exception applies.

6— Section 1035 exchange (a tax-free exchange of life insurance,

U— Dividend distribution from ESOP under section 404(k).

Boxes 14–19. If state or local income tax was withheld from the

Note: This distribution isn’t eligible for rollover.

annuity, qualified long-term care insurance, or endowment

distribution, boxes 16 and 19 may show the part of the distribution

contracts).

• Works with ALL Pressure Seal Forms 7— Normal distribution. W—Charges or payments for purchasing qualified long-term care subject to state and/or local tax.

insurance contracts under combined arrangements.

Additional information. You may want to see: Form W-4P, Form 4972,

8— Excess contributions plus earnings/excess deferrals (and/or

Form 5329, Form 8606, Pub. 525, Pub. 560, Pub. 571, Pub. 575, Pub.

earnings) taxable in 2025.

Y— Qualified charitable distribution (QCD) claimed by taxpayer under

section 408(d)(8).

590-A, Pub. 590-B, Pub. 721, Pub. 939, and Pub. 969.

9— Cost of current life insurance protection.

First-Class Mail

• Up to 5,000 Forms Per Hour

• Nationwide On-Site Service

with Telephone Support

TXF 1099R-3ARP

14” Printed EZ-Fold - 3 Around

Copies - B, C, 2 Back w/Instr. - Simplex