Page 6 - Pressure Seal Tax Catalog

P. 6

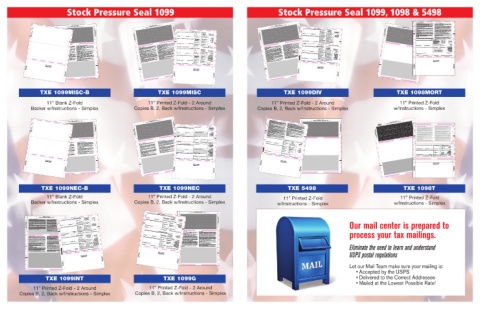

Stock Pressure Seal 1099 Stock Pressure Seal 1099, 1098 & 5498

Instructions for Payer/Borrower

A person (including a financial institution, a governmental unit, and a cooperative housing Box 2. Shows the outstanding principal on the mortgage as of January 1 of the calendar

P corporation) who is engaged in a trade or business and, in the course of such trade or year. If the mortgage originated in the calendar year, shows the mortgage principal as of the

business, received from you at least $600 of mortgage interest (including certain points) on

date of origination. If the recipient/lender acquired the loan in the calendar year, shows the

J REMOVE SIDE EDGES FIRST REMOVE SIDE EDGES FIRST any one mortgage in the calendar year must furnish this statement to you. mortgage principal as of the date of acquisition.

If you received this statement as the payer of record on a mortgage on which there are

Box 3. Shows the date of the mortgage origination.

Box 4. Do not deduct this amount. It is a refund (or credit) for overpayment(s) of interest

REMOVE SIDE EDGES FIRST

other borrowers, furnish each of the other borrowers with information about the proper

8755544 SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN REMOVE SIDE EDGES FIRST 8755565 distribution of amounts reported on this form. Each borrower is entitled to deduct only the you made in a prior year or years. If you itemized deductions in the year(s) you paid the

interest, you may have to include part or all of the box 4 amount on the “Other income” line

amount each borrower paid and points paid by the seller that represent each borrower’s

share of the amount allowable as a deduction. Each borrower may have to include in income

of your calendar year Schedule 1 (Form 1040). No adjustment to your prior year(s) tax

return(s) is necessary. For more information, see Pub. 936 and Itemized Deduction

a share of any amount reported in box 4.

If your mortgage payments were subsidized by a government agency, you may not be

Box 5. If an amount is reported in this box, it may qualify to be treated as deductible

SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN able to deduct the amount of the subsidy. See the instructions for Schedule A, C, or E Recoveries in Pub. 525.

VOID

A PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. 1a Total ordinary dividends OMB No. 1545-0110 (Form 1040) for how to report the mortgage interest. Also, for more information, see Pub. 936 mortgage interest. See the calendar year Schedule A (Form 1040) instructions and Pub. 936.

CORRECTED

and Pub. 535.

Box 6. Not all points are reportable to you. Box 6 shows points you or the seller paid this

year for the purchase of your principal residence that are required to be reported to you.

Payer’s/Borrower’s taxpayer identification number (TIN). For your protection, this form

may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the issuer

Generally, these points are fully deductible in the year paid, but you must subtract seller-paid

G

Form 1099-DIV

TXE 1099MISC-B FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION 8755536 PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. $ 1 Rents OMB No. 1545-0115 TXE 1099DIV 8289762 PAYER’S TIN $ 1b Qualified dividends $ 2b Unrecap. Sec. 1250 gain Dividends and FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST TXE 1098MORT has reported your complete TIN to the IRS. points from the basis of your residence. Other points not reported in box 6 may also be

deductible. See Pub. 936 to figure the amount you can deduct.

Account number. May show an account or other unique number the lender has assigned to

distinguish your account.

(Rev. January 2024)

Box 7. If the address of the property securing the mortgage is the same as the

REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION PAYER’S TIN RECIPIENT’S TIN 2 Royalties 4 Federal income tax withheld Miscellaneous REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION RECIPIENT’S name, Street address (including apt. no.), City or town, state or province, country, and ZIP or foreign postal code 3 2e Section 897 ordinary dividends 2d Collectibles (28%) gain income tax return, Copy 2 If you hold a mortgage credit certificate and can claim the mortgage interest credit, see Form Box 10. The interest recipient may use this box to give you other information, such as real

CORRECTED (if checked)

Box 1. Shows the mortgage interest received by the recipient/lender during the year. This

$

For calendar year

payer’s/borrower’s, either the box has been checked, or box 8 has been completed.

amount includes interest on any obligation secured by real property, including a mortgage,

Box 8. Shows the address or description of the property securing the mortgage.

Distributions

home equity loan, or line of credit. This amount does not include points, government subsidy

REMOVE THESE EDGES FIRST

REMOVE THESE EDGES FIRST

2a Total capital gain distr.

$

Box 9. If more than one property secures the loan, shows the number of properties

Form 1099-MISC

payments, or seller payments on a “buydown” mortgage. Such amounts are deductible by

securing the mortgage. If only one property secures the loan, this box may be blank.

you only in certain circumstances.

RECIPIENT’S TIN

(Rev. April 2025)

2c Section 1202 gain

$

$

If you prepaid interest in the calendar year that accrued in full by January 15

For calendar year

Information

$

estate taxes or insurance paid from escrow.

FOLD, CREASE AND TEAR ALONG PERFORATION

Box 11. If the recipient/lender acquired the mortgage in the calendar year, shows the date of

of the subsequent year, this prepaid interest may be included in box 1.

To be filed with

However, you cannot deduct the prepaid amount in the calendar year paid

recipient’s state

$

acquisition.

3 Other income

$

2f Section 897 capital gain

$

even though it may be included in box 1.

$

Future developments. For the latest information about developments related to Form 1098

when required.

Nondividend distributions

and its instructions, such as legislation enacted after they were published, go to

$

4

TXE 1099MISC

5 Fishing boat proceeds

$

Federal income tax withheld

www.irs.gov/Form1098.

6 Medical and health care payments

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost online

5

8396. If the interest was paid on a mortgage, home equity loan, or line of credit secured by a

Copy 2

qualified residence, you can only deduct the interest paid on acquisition indebtedness, and

6

$

Section 199A dividends

Investment expenses

federal tax preparation, e-filing, and direct deposit or payment options.

you may be subject to a deduction limitation.

To be filed

$

$

RECIPIENT’S name, street address (including apt. no.), city or town, state or province, country, and ZIP or foreign postal code

Foreign tax paid

8 Substitute payments in lieu of

totaling $5,000 or more of

Foreign country or U.S. possession

consumer products to

dividends or interest

recipient’s

recipient for resale

*Caution: The amount shown may

9 Crop insurance proceeds

tax return,

not be fully deductible by you. Limits

based on the loan amount and the cost

$

attorney

REMOVE THESE EDGES FIRST

$ $ 7 Payer made direct sales $ 10 Gross proceeds paid to an state income when with Account number (see instructions) 11 $ 12 7 $ 9 Cash liquidation distributions 8 10 Noncash liquidation distributions RECIPIENT’S/LENDER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. CORRECTED (if checked) OMB No. 1545-1380 Mortgage

and value of the secured property may

Exempt-interest dividends

Interest

(Rev. April 2025)

11 Fish purchased for resale $ 12 Section 409A deferrals required. C 3 E FATCA filing requirement $ 14 State 15 State identification no. 13 $ 16 Specified private activity bond interest dividends apply. Also, you may only deduct FORM 1098 Statement

Box 7. If checked, consumer products totaling $5,000 or more were sold to you for resale, on a Account number (see instructions) 13 FATCA filing requirement 14 $ 15 Nonqualified deferred beneficiaries. It is generally treated as effectively connected to a trade or business within the Form 1099-DIV www.irs.gov/Form1099DIV $ $ reimbursed by another person. For Payer/

interest to the extent it was incurred by

For calendar year

State tax withheld

FOLD, CREASE AND TEAR ALONG PERFORATION

buy-sell, a deposit-commission, or other basis. Generally, report any income from your sale of

Box 3. Shows a return of capital. To the extent of your cost (or other basis) in the stock, the distri-

you, actually paid by you, and not

Box 6. For individuals, report on Schedule C (Form 1040).

United States. See the instructions for your tax return.

1 Mortgage interest received from payer(s)/borrower(s)*

Copy B

broker on your behalf as a result of a loan of your securities. Report on the “Other income” line

compensation

$

Box 6. For individuals, report on Schedule C (Form 1040). 16 State tax withheld $ bution reduces your basis and is not taxable. Any amount received in excess of your basis is tax- RECIPIENT’S/LENDER’S TIN PAYER’S/BORROWER’S TIN 2 Outstanding mortgage principal 3 Mortgage origination date Borrower

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only

these products on Schedule C (Form 1040).

able to you as capital gain. See Pub. 550.

Recipient’s taxpayer identification number (TIN). For your protection, this form may show

only the last four digits of your social security number (SSN), individual taxpayer identification

Recipient’s taxpayer identification number (TIN). For your protection, this form may show buy-sell, a deposit-commission, or other basis. Generally, report any income from your sale of Instructions for Recipient H Form 1099-MISC www.irs.gov/Form1099MISC $ $ Instructions for Recipient not give your TIN to the payer. See Form W-9 for information on backup withholding. Include this 1a Total ordinary dividends OMB No. 1545-0110 PAYER’S/BORROWER’S name, street address (including apt. no.), city or town, state or province, country, and ZIP or foreign postal code $ 4 Refund of overpaid interest 5 Mortgage insurance premiums to the IRS. If you are required to file

the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the issuer has reported your

Instructions for Recipient Box 7. If checked, consumer products totaling $5,000 or more were sold to you for resale, on a Box 8. Shows substitute payments in lieu of dividends or tax-exempt interest received by your $ 17 State/Payer’s state no. 18 State income Box 4. Shows backup withholding. A payer must backup withhold on certain payments if you did PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Department of the Treasury - Internal Revenue Service 3-2/3” The information in boxes 1 through

Box 5. Shows the portion of the amount in box 1a that may be eligible for the 20% qualified busi-

CORRECTED (if checked)

only the last four digits of your social security number (SSN), individual taxpayer identification

$

these products on Schedule C (Form 1040).

amount on your income tax return as tax withheld.

number (ITIN), adoption taxpayer identification number (ATIN), or employer identification

Box 8. Shows substitute payments in lieu of dividends or tax-exempt interest received by your

9 and 11 is important tax

Box 6. Shows your share of expenses of a nonpublicly offered RIC, generally a nonpublicly offered

of Schedule 1 (Form 1040).

information and is being furnished

Box 9. Report this amount on Schedule F (Form 1040).

number (EIN). However, the payer has reported your complete TIN to the IRS.

number (EIN). However, the payer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the payer assigned to

Box 1a. Shows total ordinary dividends that are taxable. Include this amount on the “Ordinary divi-

Box 11. Shows the amount of cash you received for the sale of fish if you are in the trade or

Account number. May show an account or other unique number the payer assigned to broker on your behalf as a result of a loan of your securities. Report on the “Other income” line number (ITIN), adoption taxpayer identification number (ATIN), or employer identification Box 10. Shows gross proceeds paid to an attorney in connection with legal services. Report PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. 1 Rents Department of the Treasury - Internal Revenue Service Account number. May show an account or other unique number the payer assigned to distinguish ness income deduction under section 199A. See the instructions for Form 8995 and Form 8995-A. 65074 $ 1b Qualified dividends Form 1099-DIV Dividends and $ 6 Points paid on purchase of principal residence $ a return, a negligence penalty or

other sanction may be imposed on

only the taxable part as income on your return.

CORRECTED (if checked)

dends” line of Form 1040 or 1040-SR. Also report it on Schedule B (Form 1040), if required.

of Schedule 1 (Form 1040).

complete TIN to the IRS.

you if the IRS determines that an

Box 1b. Shows the portion of the amount in box 1a that may be eligible for reduced capital gains

Box 9. Report this amount on Schedule F (Form 1040).

mutual fund. This amount is included in box 1a.

rates. See the Instructions for Form 1040 for how to determine this amount and where to report.

distinguish your account.

Amounts shown may be subject to self-employment (SE) tax. Individuals should see the Box 10. Shows gross proceeds paid to an attorney in connection with legal services. Report H Amounts shown may be subject to self-employment (SE) tax. Individuals should see the Box 12. May show current year deferrals as a nonemployee under a nonqualified deferred $ 2 Royalties OMB No. 1545-0115 Miscellaneous your account. Box 7. Shows the foreign tax that you may be able to claim as a deduction or a credit on Form $ 2a Total capital gain distr. For calendar year Distributions 7 If address of property securing mortgage is the same as because you overstated a deduction

(Rev. January 2024)

$

underpayment of tax results

compensation (NQDC) plan that is subject to the requirements of section 409A plus any

Instructions for Schedule SE (Form 1040). Corporations, fiduciaries, or partnerships must

1040 or 1040-SR. See the Instructions for Form 1040.

Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7.

Instructions for Schedule SE (Form 1040). Corporations, fiduciaries, or partnerships must

The amount shown may be dividends a corporation paid directly to you as a participant (or ben-

business of catching fish.

for this mortgage interest or for

Box 11. Shows the amount of cash you received for the sale of fish if you are in the trade or

distinguish your account.

only the taxable part as income on your return.

satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code. You may

1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue

Form 1099-MISC

PAYER’S/BORROWER’S address, the box is checked,

these points, reported in boxes

Boxes 9 and 10. Show cash and noncash liquidation distributions.

report the amounts on the appropriate line of their tax returns.

Form 1099-MISC incorrect? If this form is incorrect or has been issued in error, contact the

your Form 1040 or 1040-SR but treat it as a plan distribution, not as investment income, for any

report the refund of interest (box 4);

Form 1099-MISC incorrect? If this form is incorrect or has been issued in error, contact the Box 12. May show current year deferrals as a nonemployee under a nonqualified deferred report the amounts on the appropriate line of their tax returns. Box 13. If the FATCA filing requirement box is checked, the payer is reporting on this Form $ (Rev. April 2025) Information eficiary of a participant) in an employee stock ownership plan (ESOP). Report it as a dividend on Box 11. If the FATCA filing requirement box is checked, the payer is reporting on this Form 1099 to PAYER’S TIN RECIPIENT’S TIN $ 2c Section 1202 gain 2b Unrecap. Sec. 1250 gain Copy B Q 8 Address or description of property securing mortgage or because you claimed a

$

earnings on current and prior year deferrals.

1 and 6; or because you didn't

or the address or description is entered in box 8.

payer. If you cannot get this form corrected, attach an explanation to your tax return and

$

business of catching fish.

nondeductible item.

For calendar year

calendar year. See the Instructions for Form 1040 for where to report. This amount may be subject

estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form 1040).

earnings on current and prior year deferrals.

report your information correctly. compensation (NQDC) plan that is subject to the requirements of section 409A plus any payer. If you cannot get this form corrected, attach an explanation to your tax return and Code. You may also have a filing requirement. See the Instructions for Form 8938. 3 Other income 4 Federal income tax withheld also have a filing requirement. See the Instructions for Form 8938. $ 2d Collectibles (28%) gain For Recipient

Schedule C (Form 1040) if you provided significant services to the tenant, sold real estate as a

But, if no amount is shown in boxes 2b, 2c, 2d, and 2f and your only capital gains and losses are

Box 15. Shows income as a nonemployee under an NQDC plan that does not meet the

requirements of section 409A. Any amount included in box 12 that is currently taxable is also

Box 1. Report rents from real estate on Schedule E (Form 1040). However, report rents on Box 13. If the FATCA filing requirement box is checked, the payer is reporting on this Form Box 1. Report rents from real estate on Schedule E (Form 1040). However, report rents on Box 14. Reserved for future use. PAYER’S TIN RECIPIENT’S TIN $ 5 Fishing boat proceeds $ 6 Medical and health care payments Copy B Box 2a. Shows total capital gain distributions from a regulated investment company (RIC) or real Box 12. Shows exempt-interest dividends from a mutual fund or other RIC paid to you during the RECIPIENT’S name, Street address (including apt. no.), City or town, state or province, country, and ZIP or foreign postal code 3 $ 2e Section 897 ordinary dividends 2f Section 897 capital gain This is important tax 9 Number of properties securing the mortgage 10 Other 11 Mortgage acquisition date

Schedule C (Form 1040) if you provided significant services to the tenant, sold real estate as a

report your information correctly.

other purpose.

1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue

Box 2. Report royalties from oil, gas, or mineral properties; copyrights; and patents on

subject to a substantial additional tax to be reported on Form 1040, 1040-SR, or 1040-NR.

Box 2b. Shows the portion of the amount in box 2a that is unrecaptured section 1250 gain from

business, or rented personal property as a business. See Pub. 527.

$

1040 or 1040-SR rather than Schedule D. See the Instructions for Form 1040.

to backup withholding. See Box 4 above.

Box 2. Report royalties from oil, gas, or mineral properties; copyrights; and patents on Code. You may also have a filing requirement. See the Instructions for Form 8938. business, or rented personal property as a business. See Pub. 527. included in this box. Report this amount as income on your tax return. This income is also $ $ This is important tax capital gain distributions, you may be able to report the amounts shown in box 2a on your Form Box 13. Shows exempt-interest dividends subject to the alternative minimum tax. This amount is $ 5 $ Nondividend distributions 4 $ 6 Federal income tax withheld the IRS. If you are Account number (see instructions) (Keep for your records) www.irs.gov/Form1098 Department of the Treasury - Internal Revenue Service

Schedule E (Form 1040). However, report payments for a working interest as explained in the

information and is

For Recipient

Schedule E (Form 1040). However, report payments for a working interest as explained in the

nee recipient. You must file Form 1099-DIV (with a Form 1096) with the IRS for each of the other

included in box 12. See the Instructions for Form 6251.

Schedule E (Form 1040) instructions. For royalties on timber, coal, and iron ore, see Pub. 544.

Box 14. Reserved for future use.

Box 15. Shows income as a nonemployee under an NQDC plan that does not meet the

being furnished to

Boxes 14–16. State income tax withheld reporting boxes.

Box 2c. Shows the portion of the amount in box 2a that is section 1202 gain from certain small

Boxes 16–18. Show state or local income tax withheld from the payments.

Future developments. For the latest information about developments related to Form

Box 3. Generally, report this amount on the “Other income” line of Schedule 1 (Form 1040)

and identify the payment. The amount shown may be payments received as the beneficiary of

Section 199A dividends

owners to show their share of the income, and you must furnish a Form 1099-DIV to each. A

Box 3. Generally, report this amount on the “Other income” line of Schedule 1 (Form 1040) requirements of section 409A. Any amount included in box 12 that is currently taxable is also Schedule E (Form 1040) instructions. For royalties on timber, coal, and iron ore, see Pub. 544. See the instructions for your tax return. RECIPIENT’S name, street address (including apt. no.), city or town, state or province, country, and ZIP or foreign postal code 7 Payer made direct sales 8 Substitute payments in lieu of being furnished to the certain depreciable real property. See the Unrecaptured Section 1250 Gain Worksheet in the Nominees. If this form includes amounts belonging to another person, you are considered a nomi- 7 $ Foreign tax paid $ 8 Investment expenses return, a negligence Form 1098

1099-MISC and its instructions, such as legislation enacted after they were published, go to

included in this box. Report this amount as income on your tax return. This income is also

business stock that may be subject to an exclusion. See the Schedule D (Form 1040) instructions.

required to file a

information and is

and identify the payment. The amount shown may be payments received as the beneficiary of

subject to a substantial additional tax to be reported on Form 1040, 1040-SR, or 1040-NR.

totaling $5,000 or more of

Instructions for Schedule D (Form 1040).

of collectibles. If required, use this amount when completing the 28% Rate Gain Worksheet in the

taxable income. See Pub. 525. If it is trade or business income, report this amount on

a deceased employee, prizes, awards, taxable damages, Indian gaming profits, or other

penalty or other

dividends or interest

consumer products to

taxable income. See Pub. 525. If it is trade or business income, report this amount on

Boxes 16–18. Show state or local income tax withheld from the payments.

IRS. If you are

recipient for resale

Box 2e. Shows the portion of the amount in box 1a that is section 897 gain attributable to disposi-

$

the current General Instructions for Certain Information Returns.

Foreign country or U.S. possession

Box 4. Shows backup withholding or withholding on Indian gaming profits. Generally, a payer

sanction may be

must backup withhold if you did not furnish your TIN. See Form W-9 and Pub. 505 for more

Future developments. For the latest information about developments related to Form

tax preparation, e-filing, and direct deposit or payment options.

Box 4. Shows backup withholding or withholding on Indian gaming profits. Generally, a payer 1099-MISC and its instructions, such as legislation enacted after they were published, go to Schedule C or F (Form 1040). www.irs.gov/Form1099MISC. $ 11 Fish purchased for resale 12 Section 409A deferrals other sanction may be Instructions for Schedule D (Form 1040). Account number (see instructions) 11 FATCA filing requirement 12 $ Exempt-interest dividends 10 Noncash liquidation distributions determines that it has

Schedule C or F (Form 1040). See the instructions for your tax return. a deceased employee, prizes, awards, taxable damages, Indian gaming profits, or other Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost online federal 9 Crop insurance proceeds 10 Gross proceeds paid to an required to file a return, Box 2d. Shows the portion of the amount in box 2a that is 28% rate gain from sales or exchanges spouse is not required to file a nominee return to show amounts owned by the other spouse. See PSE-Z-BLANK-POP 9 Cash liquidation distributions this income is taxable

imposed on you if

attorney

must backup withhold if you did not furnish your TIN. See Form W-9 and Pub. 505 for more

$

a negligence penalty or

$

and the IRS

$

information. Report this amount on your income tax return as tax withheld.

Box 5. Shows the amount paid to you as a fishing boat crew member by the operator, who

www.irs.gov/Form1099MISC.

tion of U.S. real property interests (USRPI).

Box 5. Shows the amount paid to you as a fishing boat crew member by the operator, who Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost online federal information. Report this amount on your income tax return as tax withheld. Account number (see instructions) 13 FATCA filing requirement 14 $ the IRS determines that Box 2f. Shows the portion of the amount in box 2a that is section 897 gain attributable to disposi- 14 State 15 State identification no. $ 16 Specified private activity bond interest dividends not been reported. FIRST-CLASS MAIL

imposed on you if this

13

tax preparation, e-filing, and direct deposit or payment options.

character when passed through or distributed to its direct or indirect foreign owners or

income is taxable and

considers you to be self-employed. Self-employed individuals must report this amount on

Schedule C (Form 1040). See Pub. 334. considers you to be self-employed. Self-employed individuals must report this amount on 15 Nonqualified deferred it has not been Note: Boxes 2e and 2f apply only to foreign persons and entities whose income maintains its Form 1099-DIV (keep for your records) $ $ State tax withheld IMPORTANT: TAX RETURN

tion of USRPI.

compensation

Schedule C (Form 1040). See Pub. 334.

reported.

$ 16 State tax withheld $ 17 State/Payer’s state no. 18 State income www.irs.gov/Form1099DIV DOCUMENT ENCLOSED

$

Form 1099-MISC (keep for your records) www.irs.gov/Form1099MISC $ $ Department of the Treasury - Internal Revenue Service

Department of the Treasury - Internal Revenue Service 7-1/3” OPENING INSTRUCTIONS

SEE OTHER SIDE FOR OPENING INSTRUCTIONS IMPORTANT: TAX RETURN FIRST-CLASS MAIL IMPORTANT: TAX RETURN SEE OTHER SIDE FOR OPENING INSTRUCTIONS SEE OTHER SIDE FOR

FIRST-CLASS MAIL

FIRST-CLASS MAIL

DOCUMENT ENCLOSED

DOCUMENT ENCLOSED

IMPORTANT: TAX RETURN

DOCUMENT ENCLOSED SEE OTHER SIDE FOR OPENING INSTRUCTIONS

SEE OTHER SIDE FOR OPENING INSTRUCTIONS OPENING INSTRUCTIONS SEE OTHER SIDE FOR OPENING INSTRUCTIONS SEE OTHER SIDE FOR

SEE OTHER SIDE FOR

OPENING INSTRUCTIONS

TXE 1099MISC-B TXE 1099MISC TXE 1099DIV TXE 1098MORT

11” Blank Z-Fold 11” Printed Z-Fold - 2 Around 11” Printed Z-Fold - 2 Around 11” Printed Z-Fold

Backer w/Instructions - Simplex Copies B, 2, Back w/Instructions - Simplex Copies B, 2, Back w/Instructions - Simplex w/Instructions - Simplex

O REMOVE SIDE EDGES FIRST REMOVE SIDE EDGES FIRST R Instructions for Participant SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN

REMOVE SIDE EDGES FIRST

REMOVE SIDE EDGES FIRST

8755556 SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN 8755567 arrangement (IRA) to report contributions, including any catch-up contributions, rollovers, repayments, THEN FOLD AND TEAR THIS STUB ALONG PERFORATION

FOLD, CREASE AND TEAR ALONG PERFORATION

FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST M distinguish your account. is not reported in box 1 or 2. 1 3 2

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement

required minimum distributions (RMDs), and the fair market value (FMV) of the account. For information

TIN to the IRS.

instructions for Forms 1040, 1040-SR, and 8606; and Pubs. 560, 590-A, and 590-B.

about IRAs, including reporting rollovers, repayments, and potential deductibility of contributions, see the

REMOVE THESE EDGES FIRST

Participant’s taxpayer identification number (TIN). For your protection, this form may show only the last

four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the trustee or issuer has reported your complete

Account number. May show an account or other unique number the trustee or issuer assigned to

TXE 1099NEC-B FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST 8755553 PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Nonemployee TXE 5498 SIMPLE IRAs in 2025. Box 13c. Shows the applicable code for a postponed contribution amount shown in box 13a: FD (due to an FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST W

Box 13a. Shows the amount of a late rollover contribution (more than 60 days after distribution) made in

does not include amounts in boxes 2–4, 8–10, 13a, and 14a.

2025 and certified by the participant, or a postponed contribution made in 2025 for a prior year. This amount

contribution is shown in box 13a, this box will be blank.

OMBNo. 1545-0116

REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION TXE 1099NEC 3 Excess golden parachute payments with recipient’s on the undistributed amount for 2026. required to be reported in box 15a. REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION 8755569

Box 13b. Shows the year to which the postponed contribution in box 13a was credited. If a late rollover

Box 1. Shows traditional IRA contributions for 2025 you made in 2025 and through April 15, 2026. This box

Box 2. Shows rollover contributions, including direct rollover contributions, you made in 2025 to an IRA

(other than conversions done through a rollover contribution from a traditional IRA or traditional SIMPLE IRA

payment to a Roth IRA. Any late rollover contributions are shown in box 13a.

extension of the contribution due date because of a federally designated disaster), PO (a rollover of a

qualified plan loan offset), and SC (the self-certification procedure for a late rollover contribution).

Compensation

to a Roth IRA or Roth SIMPLE IRA, which are reported in box 3). Include a military death gratuity or SGLI

one type of IRA to another.

For participants who served in designated combat zones, qualified hazardous duty areas, or direct

(Rev. April 2025)

support areas, the codes are EO13239 for Afghanistan and associated direct support areas, EO12744 for

Box 3. Shows the amount converted from traditional IRAs or traditional SIMPLE IRAs to Roth IRAs or Roth

For calendar year

the Arabian Peninsula areas, PL115-97 for the Sinai Peninsula of Egypt, and EO13119 (or PL106-21) for the

individual.

of locations, go to www.irs.gov/Newsroom/Combat-Zones.

Yugoslavia operations areas. For additional information, including a list of locations within the designated

Box 4. Shows amounts recharacterized from transferring any part of the contribution (plus earnings) from

combat zones, qualified hazardous duty areas, and direct support areas, see Pub. 3. For updates to the list

Box 5. Shows the FMV of all investments in your account at year end. However, if a decedent’s name is

Copy 2

Box 14a. Shows the amount of any repayment of a distribution related to a qualified reservist, qualified

shown, the amount reported may be the FMV on the date of death. If the FMV shown is zero for a decedent,

15b.

the executor or administrator of the estate may request a date-of-death value from the financial institution.

Box 7. May show the kind of IRA reported on this Form 5498.

disaster, qualified birth or adoption, emergency personal expense, domestic abuse victim, or terminally ill

abuse victim), or TI (terminally ill individual).

amount from your allowable IRA contribution included in box 1 to compute your IRA deduction.

Box 6. Shows for endowment contracts only the amount allocable to the cost of life insurance. Subtract this

Box 14b. Shows the applicable repayment code for the amount shown in box 14a: QR (qualified reservist),

To be filed

2026. Do not deduct on your income tax return.

made in 2025 for 2024, but not including contributions made in 2026 for 2025.

DD (qualified disaster), BA (qualified birth or adoption), EP (emergency personal expense), DA (domestic

distributed.

Boxes 8 and 9. Show SEP (box 8) and SIMPLE (box 9) contributions made in 2025, including contributions

market.

Box 15a. Shows the FMV of the investments in the IRA that are specified in the categories identified in box

state income

Box 10. Shows Roth IRA contributions (and rollovers from a QTP) you made in 2025 and through April 15,

tax return,

Box 15b. The following codes show the type(s) of investments held in your account for which the FMV is

D—Real estate.

established securities market).

Box 11. If the box is checked, you must take an RMD for 2026. An RMD may be required even if the box is

A—Stock or other ownership interest in a corporation that is not readily tradable on an established securities

not checked. If you do not take the RMD for 2026, you are subject to an excise tax on the amount not

B—Short- or long-term debt obligation that is not traded on an established securities market.

by January 31, 2026.

RECIPIENT'S name, street address (including apt. no.), city or town, state or province, country, and ZIP or foreign

Box 12a. Shows the date by which the RMD amount in box 12b must be distributed to avoid the excise tax

securities market).

C—Ownership interest in a limited liability company or similar entity (unless the interest is traded on an

Box 12b. Shows the amount of the RMD for 2026. If box 11 is checked and there is no amount in this box,

the trustee or issuer must provide you the amount or offer to calculate the amount in a separate statement

G—Other asset that does not have a readily available FMV.

E—Ownership interest in a partnership, trust, or similar entity (unless the interest is traded on an established

Note: If you are receiving payments on which no income, social security, and postal code when required TRUSTEE’S or ISSUER’S name, street address, city or town, state or province, country, and ZIP or foreign postal code $ 1 IRA contributions (other than amounts Q

F—Option contract or similar product that is not offered for trade on an established option exchange.

Medicare taxes are withheld, you should make estimated tax payments. See

preparation, e-filing, and direct deposit or payment options.

H—More than two types of assets (listed in A through G) are held in this IRA.

explained in these box 1 instructions. Corporations, fiduciaries, and partnerships

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost online federal tax

in boxes 2-4, 8-10, 13a, and 14a)

must report these amounts on the appropriate line of their tax returns.

Instructions for Recipient Note: If you are receiving payments on which no income, social security, and Form 1040-ES (or Form 1040-ES (NR)). Individuals must report these amounts as Form 1099-NEC www.irs.gov/Form 1099NEC TRUSTEE’S or ISSUER’S TIN $ 2 Rollover contributions OMB No. 1545-0747 CORRECTED (if checked)

You received this form instead of Form W-2 because the payer did not consider

Medicare taxes are withheld, you should make estimated tax payments. See

You received this form instead of Form W-2 because the payer did not consider Form 1040-ES (or Form 1040-ES (NR)). Individuals must report these amounts as Instructions for Recipient Box 2. If checked, consumer products totaling $5,000 or more were sold to you Department of the Treasury - Internal Revenue Service PARTICIPANT’S TIN $ 3 Roth IRA conversion amount Y

N

25

you an employee and did not withhold income tax or social security and

any income from your sale of these products on Schedule C (Form 1040).

must report these amounts on the appropriate line of their tax returns.

subject to a 20% excise tax. See your tax return instructions for where to report.

If you believe you are an employee and cannot get the payer to correct this

FORM 5498

form, report the amount shown in box 1 on the line for “Wages, salaries, tips,

If you believe you are an employee and cannot get the payer to correct this

Medicare taxes. explained in these box 1 instructions. Corporations, fiduciaries, and partnerships you an employee and did not withhold income tax or social security and for resale, on a buy-sell, a deposit-commission, or other basis. Generally, report OMB No. 1545-0116 5 FMV of account $ 4 Recharacterized contributions Contribution IRA OMB No. 1545-1574

for resale, on a buy-sell, a deposit-commission, or other basis. Generally, report

form, report the amount shown in box 1 on the line for “Wages, salaries, tips, Box 2. If checked, consumer products totaling $5,000 or more were sold to you N Medicare taxes. Box 3. Shows your total compensation of excess golden parachute payments PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Compensation PARTICIPANT’S name, street address (including apt. no.), city or town, state or province, country, and ZIP or foreign postal code 7 IRA $ 6 Life insurance cost included in box 1 Information FILER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number 1 Payments received for qualified CORRECTED (if checked)

Nonemployee

etc.” of Form 1040, 1040-SR, or 1040-NR. You must also complete Form 8919 any income from your sale of these products on Schedule C (Form 1040). etc.” of Form 1040, 1040-SR, or 1040-NR. You must also complete Form 8919 Box 4. Shows backup withholding. A payer must backup withhold on certain (Rev. April 2025) SEP $ $

tuition and related expenses

and attach it to your return. For more information, see Pub. 1779, Independent

Taxpayer Identification Number and Certification, for information on backup

If you are not an employee but the amount in box 1 is not self-employment

subject to a 20% excise tax. See your tax return instructions for where to report.

Contractor or Employee. Box 3. Shows your total compensation of excess golden parachute payments and attach it to your return. For more information, see Pub. 1779, Independent payments if you did not give your TIN to the payer. See Form W-9, Request for For calendar year 8 SEP contributions SIMPLE Roth IRA 2 25 Statement

If you are not an employee but the amount in box 1 is not self-employment

Tuition

$

Contractor or Employee.

Future developments. For the latest information about developments related to

payments if you did not give your TIN to the payer. See Form W-9, Request for

(SE) income (for example, it is income from a sporadic activity or a hobby), report Box 4. Shows backup withholding. A payer must backup withhold on certain (SE) income (for example, it is income from a sporadic activity or a hobby), report withholding. Include this amount on your income tax return as tax withheld. Copy B $ 12a RMD date $ 11 If checked, required Copy B FILER’S employer identification no. STUDENT’S TIN 3 Form 1098-T Copy B

the amount shown in box 1 on the “Other income” line (on Schedule 1 (Form

Boxes 5–7. State income tax withheld reporting boxes.

9 SIMPLE contributions

the amount shown in box 1 on the “Other income” line (on Schedule 1 (Form

10 Roth IRA contributions

Taxpayer Identification Number and Certification, for information on backup

1040)).

Recipient’s taxpayer identification number (TIN). For your protection, this form withholding. Include this amount on your income tax return as tax withheld. Recipient’s taxpayer identification number (TIN). For your protection, this form Form 1099-NEC and its instructions, such as legislation enacted after they were 3 Excess golden parachute payments This is important tax 12b RMD amount Participant For STUDENT’S name, street address (including apt. no.), city or town, state or province, country, and ZIP or foreign postal code 4 Adjustments made for a 5 Scholarships or grants For Student

For Recipient

2026

minimum distribution for

Boxes 5–7. State income tax withheld reporting boxes.

published, go to www.irs.gov/Form1099NEC.

may show only the last four digits of your TIN (social security number (SSN), Future developments. For the latest information about developments related to may show only the last four digits of your TIN (social security number (SSN), Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost information and is being Account number (see instructions) $ 13a Postponed/late contrib. $ 13b Year This information TXE 1098T $ prior year $ This is important

individual taxpayer identification number (ITIN), adoption taxpayer identification

individual taxpayer identification number (ITIN), adoption taxpayer identification

1040)).

number (ATIN), or employer identification number (EIN)). However, the issuer has

tax information

furnished to the IRS. If

and is being

is being

reported your complete TIN to the IRS. Form 1099-NEC and its instructions, such as legislation enacted after they were number (ATIN), or employer identification number (EIN)). However, the issuer has online federal tax preparation, e-filing, and direct deposit or payment options. you are required to file a 14a Repayments 14b Code 13c Code furnished to 6 Adjustments to 7 Checked if the amount IRS. This form must

published, go to www.irs.gov/Form1099NEC.

furnished to the

scholarships or grants

reported your complete TIN to the IRS.

return, a negligence

Account number. May show an account or other unique number the payer Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost Account number. May show an account or other unique number the payer RECIPIENT'S name, street address (including apt. no.), city or town, state or province, country, and ZIP or foreign Federal income tax withheld penalty or other Form 5498 academic period Form 8863 to claim

in box 1 includes

$

for a prior year

amounts for an

be used to complete

online federal tax preparation, e-filing, and direct deposit or payment options.

the IRS.

Box 1. Shows nonemployee compensation. If the amount in this box is SE

assigned to distinguish your account.

postal code

education credits.

beginning January -

sanction may be

Box 1. Shows nonemployee compensation. If the amount in this box is SE assigned to distinguish your account. imposed on you if this (keep for your records) 15a FMV of certain specified assets 15b Code(s) Service Provider/Acct. No. (see instr.) 8 Checked if at $ 9 Checked if a 10 Ins. contract reimb./refund tax preparer or

Give it to the

March 2026

income, report it on Schedule C or F (Form 1040) if a sole proprietor, or on Form income, report it on Schedule C or F (Form 1040) if a sole proprietor, or on Form the IRS determines that www.irs.gov/Form5498 Form 1098-T (keep for your records) leasthalf-time student www.irs.gov/Form1098T graduate student Department of the Treasury - Internal Revenue Service prepare the tax use it to return.

1065 and Schedule K-1 (Form 1065) if a partnership, and the recipient/partner

$

income is taxable and

1065 and Schedule K-1 (Form 1065) if a partnership, and the recipient/partner

$

completes Schedule SE (Form 1040).

it has not been

completes Schedule SE (Form 1040).

reported.

$ Department of the Treasury - Internal Revenue Service

Form 1099-NEC

(keep for your records) www.irs.gov/Form 1099NEC

Department of the Treasury - Internal Revenue Service First-Class Mail

SEE OTHER SIDE FOR OPENING INSTRUCTIONS IMPORTANT: TAX RETURN FIRST-CLASS MAIL SEE OTHER SIDE FOR OPENING INSTRUCTIONS Document Enclosed FIRST-CLASS MAIL

FIRST-CLASS MAIL

Important Tax Return

DOCUMENT ENCLOSED

IMPORTANT: TAX RETURN

DOCUMENT ENCLOSED

IMPORTANT: TAX RETURN

DOCUMENT ENCLOSED

SEE OTHER SIDE FOR OPENING INSTRUCTIONS OPENING INSTRUCTIONS SEE OTHER SIDE FOR OPENING INSTRUCTIONS SEE OTHER SIDE FOR SEE OTHER SIDE FOR OPENING INSTRUCTIONS OPENING INSTRUCTIONS SEE OTHER SIDE FOR

OPENING INSTRUCTIONS

SEE OTHER SIDE FOR

TXE 1099NEC-B TXE 1099NEC TXE 5498 TXE 1098T

11” Blank Z-Fold 11” Printed Z-Fold - 2 Around 11” Printed Z-Fold 11” Printed Z-Fold

Backer w/Instructions - Simplex Copies B, 2, Back w/Instructions - Simplex w/Instructions - Simplex w/Instructions - Simplex

D REMOVE SIDE EDGES FIRST

SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN

VOID

7984716 PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. 1 Unemployment compensation

CORRECTED

FOLD, CREASE AND TEAR ALONG PERFORATION

REMOVE SIDE EDGES FIRST

SLIDE FINGER BETWEEN FRONT & MIDDLE PANEL TO OPEN $ OMB No. 1545-0120

CORRECTED (if checked) OMB No. 1545-0112 Interest PAYER’S TIN 2 State or local income tax Form 1099-G

PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no.

(Rev. January 2024)

refunds, credits, or offsets

Instructions for Recipient (continued) Box 13. For a tax-exempt covered security, shows the amount of premium amortization allo- Payer’s RTN (optional) Form 1099-INT Income Copy 2 TXE 1099G RECIPIENT’S name, Street address (including apt. no.), City or town, state or province, country, ZIP or foreign postal code $ 3 Box 2 amount is for tax year 4 Federal income tax withheld REMOVE THESE EDGES FIRST Government FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST

(Rev. January 2022)

Box 11. For a taxable covered security (other than a U.S. Treasury obligation), shows the

RECIPIENT’S TIN

For calendar year

Certain

For calendar year

1 Interest income

amount of premium amortization allocable to the interest payment(s), unless you notified the

cable to the interest payment(s). If an amount is reported in this box, see Pub. 550 to deter-

D

payer in writing in accordance with Regulations section 1.6045-1(n)(5) that you did not want

20

mine the net amount of tax-exempt interest reportable on Form 1040 or 1040-SR. If an

to amortize bond premium under section 171. If an amount is reported in this box, see the

Payments

amount is not reported in this box for a tax-exempt covered security acquired at a premium,

Instructions for Schedule B (Form 1040) to determine the net amount of interest includible in

the payer has reported a net amount of interest in box 8 or 9, whichever is applicable. If the

$

3 Interest on U.S. Savings Bonds and Treasury obligations

REMOVE THESE EDGES FIRST FOLD, CREASE AND TEAR ALONG PERFORATION income on Form 1040 or 1040-SR with respect to the security. If an amount is not reported in amount in box 13 is greater than the amount of interest paid on the tax-exempt covered FOLD, CREASE AND TEAR ALONG PERFORATION REMOVE THESE EDGES FIRST RECIPIENT’S TIN 2 Early withdrawal penalty 5 Investment expenses income tax return, Form 1099-G $ 7 Agriculture payments $ 8 Check if box 2 is recipient’s state Our mail center is prepared to

$

8291364

security, the excess is a nondeductible loss. See Regulations section 1.171-2(a)(4)(ii).

this box for a taxable covered security acquired at a premium and the payer is reporting pre-

5 RTAA payments

$

Box 14. Shows CUSIP number(s) for tax-exempt bond(s) on which tax-exempt interest was

mium amortization, the payer has reported a net amount of interest in box 1. If the amount in

$

To be filed with

box 11 is greater than the amount of interest paid on the covered security, see Regulations

paid, or tax credit bond(s) on which taxable interest was paid or tax credit was allowed, to

6 Taxable grants

recipient’s state

Copy 2

4 Federal income tax withheld

$

section 1.171-2(a)(4).

you during the calendar year. If blank, no CUSIP number was issued for the bond(s).

Box 12. For a U.S. Treasury obligation that is a covered security, shows the amount of premi-

Boxes 15–17. State tax withheld reporting boxes.

To be filed with

7 Foreign country or U.S. territory

$

$

when required.

Nominees. If this form includes amounts belonging to another person(s), you are considered

RECIPIENT’S name, Street address (including apt. no.), City or town, state or province, country, and ZIP or foreign postal code

PAYER’S TIN

um amortization allocable to the interest payment(s), unless you notified the payer in writing

in accordance with Regulations section 1.6045-1(n)(5) that you did not want to amortize bond

$

a nominee recipient. Complete a Form 1099-INT for each of the other owners showing the

income allocable to each. File Copy A of the form with the IRS. Furnish Copy B to each

9 Market gain

Specified private activity bond interest

income

premium under section 171. If an amount is reported in this box, see the Instructions for

trade or business

Account number (see instructions)

income tax

6 Foreign tax paid

Schedule B (Form 1040) to determine the net amount of interest includible in income on Form

9

owner. List yourself as the “payer” and the other owner(s) as the “recipient.” File Form(s)

return, when

1099-INT with Form 1096 with the Internal Revenue Service Center for your area. On Form

1040 or 1040-SR with respect to the U.S. Treasury obligation. If an amount is not reported in

$

1096, list yourself as the “filer.” A spouse is not required to file a nominee return to show

$

this box for a U.S. Treasury obligation that is a covered security acquired at a premium and

the payer is reporting premium amortization, the payer has reported a net amount of interest

amounts owned by the other spouse.

10a State 10b State identification no.

13 Bond premium on tax-exempt bond

Market discount

Future developments. For the latest information about developments related to Form 1099-

in box 3. If the amount in box 12 is greater than the amount of interest paid on the U.S.

$

INT and its instructions, such as legislation enacted after they were published, go to

Treasury obligation, see Regulations section 1.171-2(a)(4).

$

www.irs.gov/Form1099INT. TXE 1099INT 8 $ 10 Tax-exempt interest 11 Bond premium State tax withheld www.irs.gov/Form1099G $ $ 11 State income tax withheld required.

$

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost online feder- 12 Bond premium on Treasury obligations State 16 State identification no. 17 $

al tax preparation, e-filing, and direct deposit or payment options. $ Tax-exempt and tax credit 15 $ 3-2/3” Instructions for Recipient shown were made.

FATCA filing 14 bond CUSIP no. Department of the Treasury - Internal Revenue Service PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. 1 Unemployment compensation Department of the Treasury - Internal Revenue Service Recipient’s taxpayer identification number (TIN). For your protection, this form Box 4. Shows backup withholding or withholding you requested on unemploy-

requirement

may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However,

ment compensation, Commodity Credit Corporation (CCC) loans, or certain crop

CORRECTED (if checked)

3-2/3”

Account number (see instructions) www.irs.gov/Form1099INT $ OMB No. 1545-0120 the issuer has reported your complete TIN to the IRS. disaster payments. Generally, a payer must backup withhold on certain payments process your tax mailings.

if you did not give your TIN to the payer. See Form W-9 for information on back-

Account number. May show an account or other unique number the payer has

up withholding. Include this amount on your income tax return as tax withheld.

assigned to distinguish your account.

Box 5. Shows reemployment trade adjustment assistance (RTAA) payments you

C OMB No. 1545-0112 Interest PAYER’S TIN Form 1099-G Caution: Identity Theft (IDT). If you suspect that you are a victim of IDT, do not received. Include on the “Other income” line of Schedule 1 (Form 1040).

Form 1099-INT

report the incorrect amount shown in box 1 of Form(s) 1099-G on your tax

Payer’s RTN (optional)

ment.

PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no.

(Rev. January 2024)

Instructions for Recipient may deduct this amount to figure your adjusted gross income on your income tax return. CORRECTED (if checked) Form 1099-INT Income 2 State or local income tax (Rev. January 2022) Certain return. Go to www.irs.gov/idtheftunemployment for more information. Box 6. Shows taxable grants you received from a federal, state, or local govern-

refunds, credits, or offsets

Box 1. Shows the total unemployment compensation (UC) paid to you in the cal-

The information provided may be different for covered and noncovered securities. For a See the Instructions for Form 1040 to see where to take the deduction. RECIPIENT’S TIN $ Government endar year reported. Combine the box 1 amounts from all Forms 1099-G and Box 7. Shows your taxable Department of Agriculture payments. If the payer

description of covered securities, see the Instructions for Form 8949. For a taxable covered Box 3. Shows interest on U.S. Savings Bonds, Treasury bills, Treasury bonds, and Treasury For calendar year For calendar year report the total as income on the UC line of your tax return. Except as explained shown is anyone other than the Department of Agriculture, it means the payer X

security acquired at a premium, unless you notified the payer in writing in accordance with notes. This may or may not all be taxable. See Pub. 550. This interest is exempt from state 1 Interest income Copy B Payments

Regulations section 1.6045-1(n)(5) that you did not want to amortize the premium under sec- and local income taxes. This interest is not included in box 1. See the instructions above for E RECIPIENT’S name, Street address (including apt. no.), City or town, state or province, country, ZIP or foreign postal code 3 Box 2 amount is for tax year 20 below, this is your taxable amount. If you made contributions to a governmental has received a payment, as a nominee, that is taxable to you. This may represent

tion 171, or for a tax-exempt covered security acquired at a premium, your payer must gen- a taxable covered security acquired at a premium. $ For Recipient UC program or to a governmental paid family leave program and received a pay- the entire agricultural subsidy payment received on your behalf by the nominee,

or it may be your pro rata share of the original payment. See Pub. 225 and the

ment from that program, the payer must issue a separate Form 1099-G to report

erally report either (1) a net amount of interest that reflects the offset of the amount of interest Box 4. Shows backup withholding. Generally, a payer must backup withhold if you did not This is important tax 4 Federal income tax withheld this amount to you. If you itemize deductions, you may deduct your contributions Schedule F (Form 1040) instructions for information about where to report this

paid to you by the amount of premium amortization allocable to the payment(s), or (2) a gross furnish your TIN or you did not furnish the correct TIN to the payer. See Form W-9. Include 2 Early withdrawal penalty $

62982

amount for both the interest paid to you and the premium amortization allocable to the pay- this amount on your income tax return as tax withheld. 3 Interest on U.S. Savings Bonds and Treasury obligations information and is 5 RTAA payments on Schedule A (Form 1040) as taxes paid. If you do not itemize, only include in income. Partnerships, see Form 8825 for how to report.

ment(s). If you did notify your payer that you did not want to amortize the premium on a tax- Box 5. Any amount shown is your share of investment expenses of a single-class REMIC. $ being furnished to the $ 6 Taxable grants Copy B income the amount that is in excess of your contributions. Box 8. If this box is checked, the amount in box 2 is attributable to an income

tax that applies exclusively to income from a trade or business and is not a tax of

able covered security, then your payer will only report the gross amount of interest paid to This amount is included in box 1. Note: This amount is not deductible. 5 Investment expenses IRS. If you are For Recipient Box 2. Shows refunds, credits, or offsets of state or local income tax you

you. For a noncovered security acquired at a premium, your payer is only required to report Box 6. Shows foreign tax paid. You may be able to claim this tax as a deduction or a credit $ 7 Agriculture payments $ received. It may be taxable to you if you deducted the state or local income tax general application. If taxable, report the amount in box 2 on Schedule C or F

the gross amount of interest paid to you. on your Form 1040 or 1040-SR. See your tax return instructions. F RECIPIENT’S TIN 4 Federal income tax withheld required to file a return, paid on Schedule A (Form 1040). Even if you did not receive the amount shown, (Form 1040), as appropriate.

Recipient’s taxpayer identification number (TIN). For your protection, this form may show Box 7. Shows the country or U.S. territory to which the foreign tax was paid. $ a negligence penalty or $ This is important tax for example, because (a) it was credited to your state or local estimated tax, (b) it

information and is

only the last four digits of your TIN (social security number (SSN), individual taxpayer identifi- Box 8. Shows tax-exempt interest paid to you during the calendar year by the payer. See PAYER’S TIN $ 7 Foreign country or U.S. territory other sanction may be Account number (see instructions) 8 If checked, box 2 is being furnished to the was offset against federal or state debts, (c) it was offset against other offsets, or Box 9. Shows market gain on CCC loans whether repaid using cash or CCC cer-

tificates. See the Schedule F (Form 1040) instructions.

cation number (ITIN), adoption taxpayer identification number (ATIN), or employer identifica- how to report this amount in the Instructions for Form 1040. This amount may be subject to imposed on you if this 9 Market gain income trade or business IRS. If you are required (d) you made a charitable contribution from your refund, it is still taxable if it was Boxes 10a–11. State income tax withheld reporting boxes.

tion number (EIN)). However, the issuer has reported your complete TIN to the IRS. backup withholding. See Box 4 above. See the instructions above for a tax-exempt covered RECIPIENT’S name, Street address (including apt. no.), City or town, state or province, country, and ZIP or foreign postal code 6 Foreign tax paid $ deducted. If you received interest on this amount, you may receive Form 1099-

FATCA filing requirement. If the FATCA filing requirement box is checked, the payer is security acquired at a premium. $ 9 Specified private activity bond interest income is taxable and Form 1099-G to file a return, a Future developments. For the latest information about developments related to

reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement. You may Box 9. Shows tax-exempt interest subject to the alternative minimum tax. This amount is 8 Tax-exempt interest $ the IRS determines that negligence penalty or INT for the interest. However, the payer may include interest of less than $600 in Form 1099-G and its instructions, such as legislation enacted after they were

published, go to www.irs.gov/Form1099G.

the blank box next to box 9 on Form 1099-G. Regardless of whether the interest

also have a filing requirement. See the Instructions for Form 8938. included in box 8. See the Instructions for Form 6251. See the instructions above for a tax- 11 Bond premium it has not been reported. 10a State 10b State identification no. other sanction may be is reported to you, report it as interest income on your tax return. See your tax

Account number. May show an account or other unique number the payer assigned to dis- exempt covered security acquired at a premium. $ (keep for your records) imposed on you if this return instructions. Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost

tinguish your account. Box 10. For a taxable or tax-exempt covered security, if you made an election under section 10 Market discount $ online federal tax preparation, e-filing, and direct deposit or payment options.

Payer’s Routing Transit Number (RTN). A payer may include the RTN to identify the bank or 1278(b) to include market discount in income as it accrues and you notified your payer of $ 13 Bond premium on tax-exempt bond State tax withheld 11 State income tax withheld the IRS determines that Box 3. Identifies the tax year for which the box 2 refunds, credits, or offsets

$

income is taxable and

$

financial institution where your account is held. the election in writing in accordance with Regulations section 1.6045-1(n)(5), shows the mar- 12 Bond premium on Treasury obligations $ www.irs.gov/Form1099G it has not been Eliminate the need to learn and understand

Box 1. Shows taxable interest paid to you during the calendar year by the payer. This does ket discount that accrued on the debt instrument during the year while held by you, unless it 15 State 16 State identification no. 17 $

not include interest shown in box 3. May also show the total amount of the credits from clean $ $ reported.

renewable energy bonds, new clean renewable energy bonds, qualified energy conservation was reported on Form 1099-OID. For a taxable or tax-exempt covered security acquired on

bond CUSIP no.

requirement

bonds, qualified zone academy bonds, qualified school construction bonds, and build or after January 1, 2015, accrued market discount will be calculated on a constant yield FATCA filing 14 Tax-exempt and tax credit Department of the Treasury - Internal Revenue Service Department of the Treasury - Internal Revenue Service

basis unless you notified your payer in writing in accordance with Regulations section

America bonds that must be included in your interest income. These amounts were treated 1.6045-1(n)(5) that you did not want to make a constant yield election for market discount

as paid to you during the calendar year on the credit allowance dates (March 15, June 15,

September 15, and December 15). For more information, see Form 8912. See the instruc- under section 1276(b). Report the accrued market discount on your income tax return as PSEZ-BlnkFB-POP www.irs.gov/Form1099INT

tions above for a taxable covered security acquired at a premium. directed in the Instructions for Form 1040. Market discount on a tax-exempt security is Account number (see instructions) 7-1/3”

includible in taxable income as interest income.

Box 2. Shows interest or principal forfeited because of early withdrawal of time savings. You (Continued on the back of Copy 2.) (keep for your records) 7-1/3”

Form 1099-INT FIRST-CLASS MAIL

IMPORTANT: TAX RETURN

DOCUMENT ENCLOSED

FIRST-CLASS MAIL SEE OTHER SIDE FOR OPENING INSTRUCTIONS USPS postal regulations

IMPORTANT: TAX RETURN

DOCUMENT ENCLOSED OPENING INSTRUCTIONS SEE OTHER SIDE FOR

SEE OTHER SIDE FOR OPENING INSTRUCTIONS OPENING INSTRUCTIONS SEE OTHER SIDE FOR Let our Mail Team make sure your mailing is:

• Accepted by the USPS

TXE 1099INT TXE 1099G • Delivered to the Correct Addressee

• Mailed at the Lowest Possible Rate!

11” Printed Z-Fold - 2 Around 11” Printed Z-Fold - 2 Around

Copies B, 2, Back w/Instructions - Simplex Copies B, 2, Back w/Instructions - Simplex